Whales bought the dip, quietly and brutally.

By Maxime Laurent · 2026-02-09 11:42

Whales bought the dip, quietly and brutally.

Big wallets absorbed 66,940 $BTC as risk metrics hit extreme fear levels.

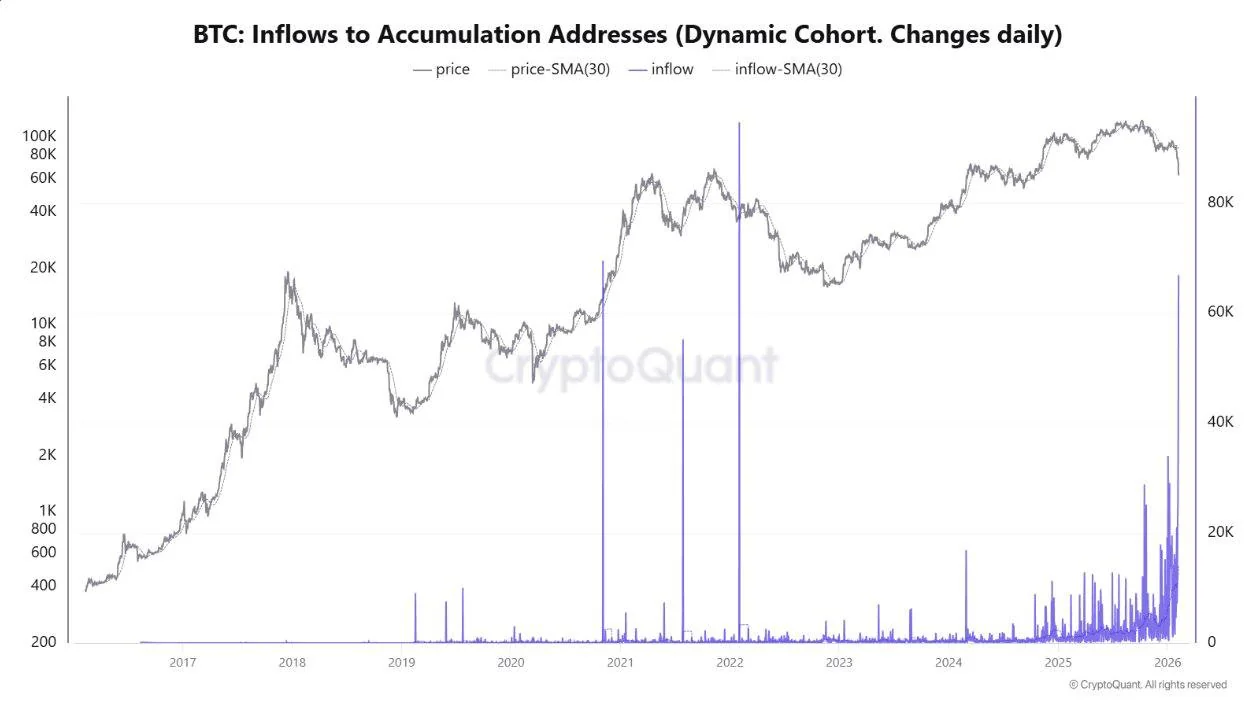

While everyone was staring at red candles, something else was happening under the surface. On February 6, large wallets accumulated 66,940 $BTC in a single day — the biggest inflow of this entire market cycle. No drama, no tweets, just cold accumulation. 🐋

At the same time, the Sharpe ratio — a measure of return adjusted for risk — collapsed to -10, its lowest level since March 2023. According to analyst Darkfost, when this indicator sinks into negative territory, it has historically marked the final phase of bear markets.

Now, let’s be clear. This doesn’t mean instant moon. Risks still outweigh potential returns right now, and this phase can drag on for months. Price can still bleed, chop, test patience. That’s usually how it works. Markets don’t flip when confidence is high — they flip when conviction is exhausted.

From my perspective, feet up, sea breeze rolling in, this feels like classic late-cycle tension. Smart money is positioning early, knowing full well they’ll look wrong before they look right. C’est pas joli, but it’s familiar.

Accumulation first. Comfort later. 🌊☕️

#Bitcoin #BTC #OnChain #Whales #MarketCycle #CryptoFriture

Big wallets absorbed 66,940 $BTC as risk metrics hit extreme fear levels.

While everyone was staring at red candles, something else was happening under the surface. On February 6, large wallets accumulated 66,940 $BTC in a single day — the biggest inflow of this entire market cycle. No drama, no tweets, just cold accumulation. 🐋

At the same time, the Sharpe ratio — a measure of return adjusted for risk — collapsed to -10, its lowest level since March 2023. According to analyst Darkfost, when this indicator sinks into negative territory, it has historically marked the final phase of bear markets.

Now, let’s be clear. This doesn’t mean instant moon. Risks still outweigh potential returns right now, and this phase can drag on for months. Price can still bleed, chop, test patience. That’s usually how it works. Markets don’t flip when confidence is high — they flip when conviction is exhausted.

From my perspective, feet up, sea breeze rolling in, this feels like classic late-cycle tension. Smart money is positioning early, knowing full well they’ll look wrong before they look right. C’est pas joli, but it’s familiar.

Accumulation first. Comfort later. 🌊☕️

#Bitcoin #BTC #OnChain #Whales #MarketCycle #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.