Wall Street doubles down on Ethereum proxy.

By Maxime Laurent · 2026-02-20 10:24

Wall Street doubles down on Ethereum proxy.

Big US institutions increase exposure to BitMine — even after a 48% stock drop.

This is where things get interesting.

Major US banks and asset managers have reportedly increased positions in BitMine, the company associated with

Tom Lee — now described as the largest corporate holder of $ETH.

Despite BMNR shares falling 48% in Q4.

Pause there.

When institutions add exposure during equity weakness, it’s rarely emotional. It’s strategic positioning.

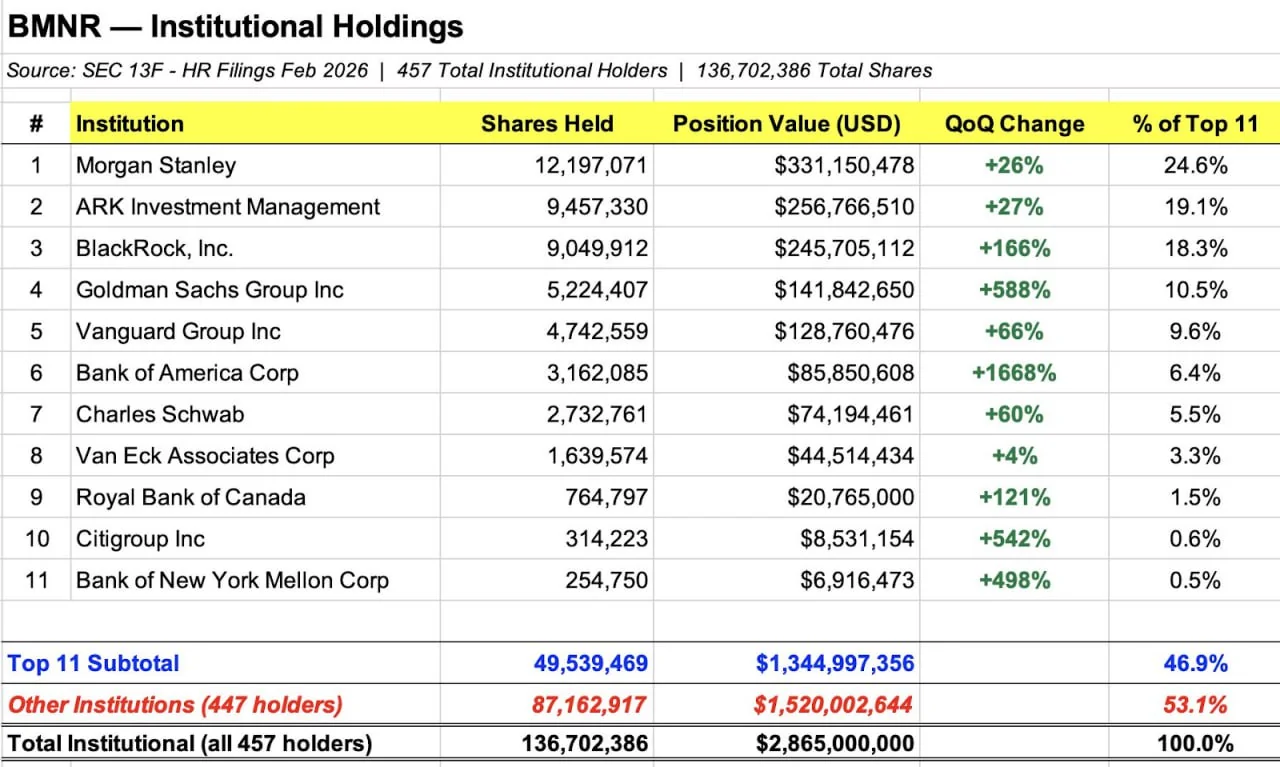

The 11 largest shareholders now represent roughly half of total institutional holdings — about $2.8 billion equivalent.

That’s serious conviction capital.

Let’s break down what’s happening structurally.

BitMine is essentially becoming an Ethereum treasury proxy — similar to how

Strategy became a leveraged $BTC vehicle.

When institutions buy BMNR, they’re not just buying a stock. They’re buying:

– Exposure to $ETH price dynamics

– Corporate treasury accumulation strategy

– Potential leverage to staking yield

– A structured equity wrapper instead of direct token custody

Some funds simply can’t hold crypto directly due to mandates or compliance rules. But they can hold equities.

So these corporate crypto vehicles become bridges.

Now, about the 48% drop.

Equity volatility doesn’t automatically invalidate the thesis. In fact, high-beta crypto equities often overshoot both up and down relative to the underlying asset.

If institutions are increasing allocation during that drawdown, it suggests they view it as mispricing — not collapse.

Watching how $ETH quietly strengthens its institutional footprint, I feel like we’re witnessing something subtle:

Ethereum is no longer just “the DeFi chain.”

It’s becoming balance-sheet infrastructure.

First $BTC got the corporate treasury narrative.

Now $ETH is entering that arena.

Et ça, c’est un changement structurel. 🔥🌊

#Ethereum #ETH #Institutional #TomLee #Crypto #Markets

Big US institutions increase exposure to BitMine — even after a 48% stock drop.

This is where things get interesting.

Major US banks and asset managers have reportedly increased positions in BitMine, the company associated with

Tom Lee — now described as the largest corporate holder of $ETH.

Despite BMNR shares falling 48% in Q4.

Pause there.

When institutions add exposure during equity weakness, it’s rarely emotional. It’s strategic positioning.

The 11 largest shareholders now represent roughly half of total institutional holdings — about $2.8 billion equivalent.

That’s serious conviction capital.

Let’s break down what’s happening structurally.

BitMine is essentially becoming an Ethereum treasury proxy — similar to how

Strategy became a leveraged $BTC vehicle.

When institutions buy BMNR, they’re not just buying a stock. They’re buying:

– Exposure to $ETH price dynamics

– Corporate treasury accumulation strategy

– Potential leverage to staking yield

– A structured equity wrapper instead of direct token custody

Some funds simply can’t hold crypto directly due to mandates or compliance rules. But they can hold equities.

So these corporate crypto vehicles become bridges.

Now, about the 48% drop.

Equity volatility doesn’t automatically invalidate the thesis. In fact, high-beta crypto equities often overshoot both up and down relative to the underlying asset.

If institutions are increasing allocation during that drawdown, it suggests they view it as mispricing — not collapse.

Watching how $ETH quietly strengthens its institutional footprint, I feel like we’re witnessing something subtle:

Ethereum is no longer just “the DeFi chain.”

It’s becoming balance-sheet infrastructure.

First $BTC got the corporate treasury narrative.

Now $ETH is entering that arena.

Et ça, c’est un changement structurel. 🔥🌊

#Ethereum #ETH #Institutional #TomLee #Crypto #Markets

Disclaimer: This content is for informational purposes only and not financial advice.