The silent whales are back.

By Maxime Laurent · 2026-02-17 13:52

The silent whales are back.

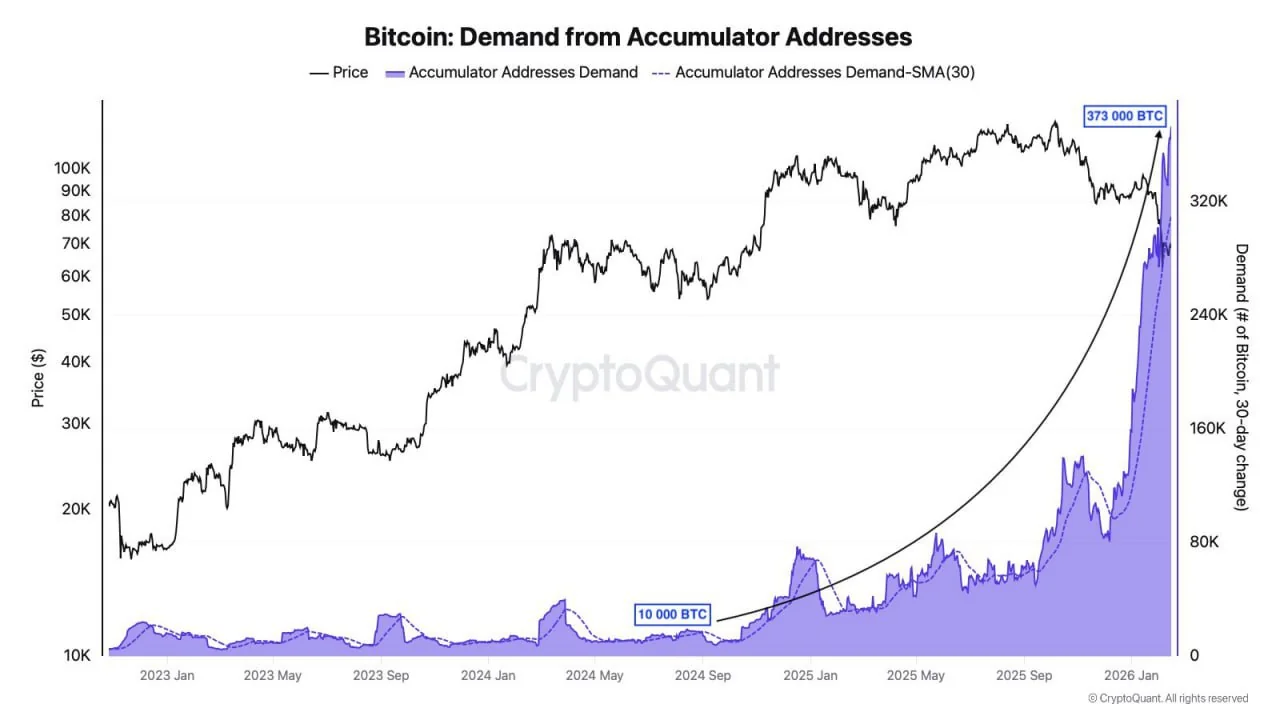

Accumulation addresses are stacking ~373,000 $BTC per month — that’s not retail noise.

This is the kind of data that makes me lean back in my chair and just stare at the sea for a minute.

According to on-chain metrics from CryptoQuant, so-called “accumulation addresses” are absorbing around 373,000 BTC per month right now.

Let me repeat that.

Three. Hundred. Seventy-three. Thousand. $BTC.

In September 2024 — just before Bitcoin first pushed toward $100,000 — that number was around 10,000 BTC per month.

This isn’t a small increase.

It’s an order-of-magnitude shift.

And here’s what makes it even more interesting:

These addresses exclude known exchange wallets and miner addresses.

And they show no significant outflows.

Translation? This is long-term conviction behavior.

Accumulation addresses are typically wallets that:

– steadily receive BTC

– don’t sell

– aren’t linked to trading platforms

– aren’t miner distribution wallets

That smells like high-net-worth individuals, funds, possibly corporate treasuries. Strategic positioning.

Now, I’m not saying “price must pump tomorrow.” Markets don’t work like that. Liquidity, macro, derivatives positioning — all of that still matters.

But structurally? This is supply compression.

If 373,000 BTC per month moves into cold hands, that’s coins leaving the liquid arena. And $BTC’s issuance is fixed. No central bank. No surprise unlock.

It reminds me of late 2024. The calm before the narrative explosion.

Back then, accumulation was quiet. Then suddenly everyone on X was screaming “new ATH.” By the time headlines arrive, the positioning is already done.

This kind of on-chain behavior feels… deliberate.

Smart money doesn’t tweet.

It accumulates.

Ça sent la stratégie long terme. 🌊🔥

#Bitcoin #BTC #OnChain #Crypto #Accumulation #MarketStructure

Accumulation addresses are stacking ~373,000 $BTC per month — that’s not retail noise.

This is the kind of data that makes me lean back in my chair and just stare at the sea for a minute.

According to on-chain metrics from CryptoQuant, so-called “accumulation addresses” are absorbing around 373,000 BTC per month right now.

Let me repeat that.

Three. Hundred. Seventy-three. Thousand. $BTC.

In September 2024 — just before Bitcoin first pushed toward $100,000 — that number was around 10,000 BTC per month.

This isn’t a small increase.

It’s an order-of-magnitude shift.

And here’s what makes it even more interesting:

These addresses exclude known exchange wallets and miner addresses.

And they show no significant outflows.

Translation? This is long-term conviction behavior.

Accumulation addresses are typically wallets that:

– steadily receive BTC

– don’t sell

– aren’t linked to trading platforms

– aren’t miner distribution wallets

That smells like high-net-worth individuals, funds, possibly corporate treasuries. Strategic positioning.

Now, I’m not saying “price must pump tomorrow.” Markets don’t work like that. Liquidity, macro, derivatives positioning — all of that still matters.

But structurally? This is supply compression.

If 373,000 BTC per month moves into cold hands, that’s coins leaving the liquid arena. And $BTC’s issuance is fixed. No central bank. No surprise unlock.

It reminds me of late 2024. The calm before the narrative explosion.

Back then, accumulation was quiet. Then suddenly everyone on X was screaming “new ATH.” By the time headlines arrive, the positioning is already done.

This kind of on-chain behavior feels… deliberate.

Smart money doesn’t tweet.

It accumulates.

Ça sent la stratégie long terme. 🌊🔥

#Bitcoin #BTC #OnChain #Crypto #Accumulation #MarketStructure

Disclaimer: This content is for informational purposes only and not financial advice.