The liquidation illusion.

By Maxime Laurent · 2025-10-13 16:41

The liquidation illusion.

CEXs may be hiding the real storm behind the stats.

Jeff Yan, co-founder of Hyperliquid, just dropped a spicy take — centralized exchanges might be massively underreporting liquidation volumes. According to him, during high-volatility spikes, real figures can be up to 100× higher than what platforms show publicly. 😳

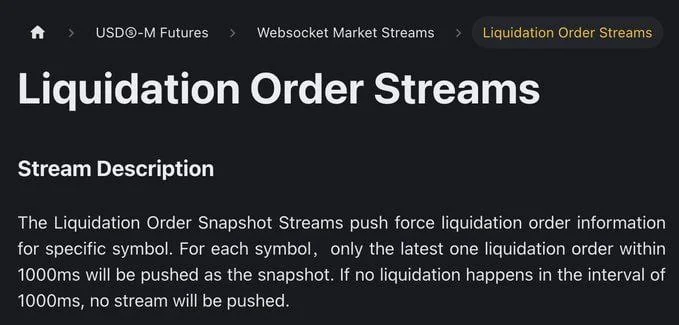

Turns out, some CEXs (including Binance) only report one order per second, even if thousands are being executed in that instant. When liquidations come in waves, this kind of throttling makes the data look way calmer than reality.

CoinGlass said on October 11 that 1.6 million traders got liquidated for a total of $19.1 billion. But if Yan’s right, the true number could be far scarier. It’s another reminder that in crypto, transparency often stops where volatility begins — and the rest, mon ami, is smoke and mirrors. 💨

#Bitcoin #CryptoExchanges #Liquidations #Binance #Hyperliquid #CEX #CryptoFriture

CEXs may be hiding the real storm behind the stats.

Jeff Yan, co-founder of Hyperliquid, just dropped a spicy take — centralized exchanges might be massively underreporting liquidation volumes. According to him, during high-volatility spikes, real figures can be up to 100× higher than what platforms show publicly. 😳

Turns out, some CEXs (including Binance) only report one order per second, even if thousands are being executed in that instant. When liquidations come in waves, this kind of throttling makes the data look way calmer than reality.

CoinGlass said on October 11 that 1.6 million traders got liquidated for a total of $19.1 billion. But if Yan’s right, the true number could be far scarier. It’s another reminder that in crypto, transparency often stops where volatility begins — and the rest, mon ami, is smoke and mirrors. 💨

#Bitcoin #CryptoExchanges #Liquidations #Binance #Hyperliquid #CEX #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.