Strategy buys the dip, ETFs leak.

By Maxime Laurent · 2026-02-17 13:55

Strategy buys the dip, ETFs leak.

2486 $BTC added while capital rotates out of ETFs — two very different games.

There’s something almost cinematic about this contrast.

On one side, Strategy (yes, the company formerly known as MicroStrategy) just bought 2,486 BTC at an average price of $67,710, spending around $168M in a single week.

Their total stack now sits at 717,131 BTC — worth roughly $54.5B.

Average acquisition price? $76,027.

They’re still underwater on paper.

And they’re still buying.

That’s conviction. Or obsession. Maybe both.

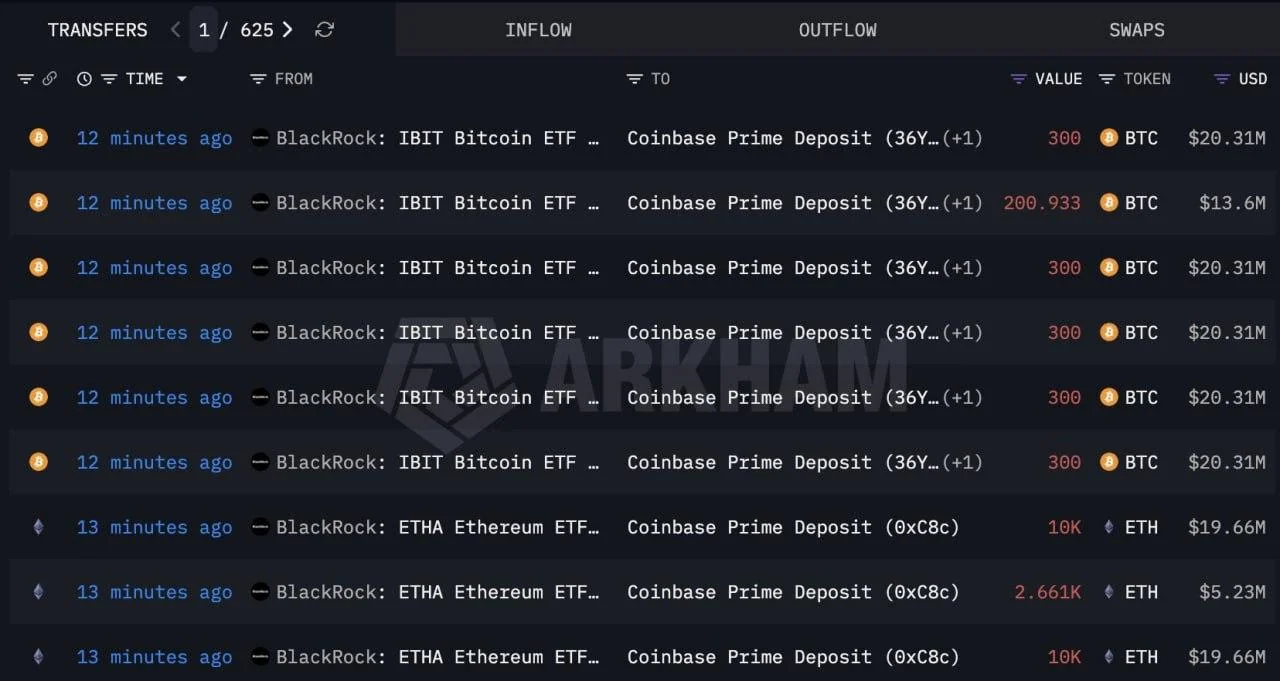

On the other side, BlackRock is reportedly moving funds toward Coinbase Prime, signaling ETF outflows.

That’s rotation.

ETF investors are typically more tactical. They rebalance. They de-risk. They react to macro, flows, volatility. It’s portfolio math.

Strategy plays a different game.

They don’t manage quarterly ETF flows. They manage a corporate Bitcoin thesis. Their balance sheet is basically a leveraged $BTC proxy.

When ETF capital leaves but Strategy accumulates, it tells us something subtle:

Institutions are not monolithic.

Some are trimming exposure.

Some are doubling down.

And here’s the interesting tension — if ETF redemptions increase short-term supply, but long-term holders absorb it, you get a transfer of coins from weak hands to strong balance sheets.

That’s how cycles quietly reset.

From where I sit, watching the sea and the order books, this doesn’t feel like capitulation. It feels like redistribution.

The big question isn’t who’s selling.

It’s who’s holding in five years.

Et là, Strategy seems very clear about its answer. 🔥🌊

#Bitcoin #BTC #Strategy #BlackRock #ETF #MarketStructure

2486 $BTC added while capital rotates out of ETFs — two very different games.

There’s something almost cinematic about this contrast.

On one side, Strategy (yes, the company formerly known as MicroStrategy) just bought 2,486 BTC at an average price of $67,710, spending around $168M in a single week.

Their total stack now sits at 717,131 BTC — worth roughly $54.5B.

Average acquisition price? $76,027.

They’re still underwater on paper.

And they’re still buying.

That’s conviction. Or obsession. Maybe both.

On the other side, BlackRock is reportedly moving funds toward Coinbase Prime, signaling ETF outflows.

That’s rotation.

ETF investors are typically more tactical. They rebalance. They de-risk. They react to macro, flows, volatility. It’s portfolio math.

Strategy plays a different game.

They don’t manage quarterly ETF flows. They manage a corporate Bitcoin thesis. Their balance sheet is basically a leveraged $BTC proxy.

When ETF capital leaves but Strategy accumulates, it tells us something subtle:

Institutions are not monolithic.

Some are trimming exposure.

Some are doubling down.

And here’s the interesting tension — if ETF redemptions increase short-term supply, but long-term holders absorb it, you get a transfer of coins from weak hands to strong balance sheets.

That’s how cycles quietly reset.

From where I sit, watching the sea and the order books, this doesn’t feel like capitulation. It feels like redistribution.

The big question isn’t who’s selling.

It’s who’s holding in five years.

Et là, Strategy seems very clear about its answer. 🔥🌊

#Bitcoin #BTC #Strategy #BlackRock #ETF #MarketStructure

Disclaimer: This content is for informational purposes only and not financial advice.