Solana is quietly becoming the new darling of corporate trea...

By Maxime Laurent · 2025-09-08 10:50

Solana is quietly becoming the new darling of corporate treasuries.

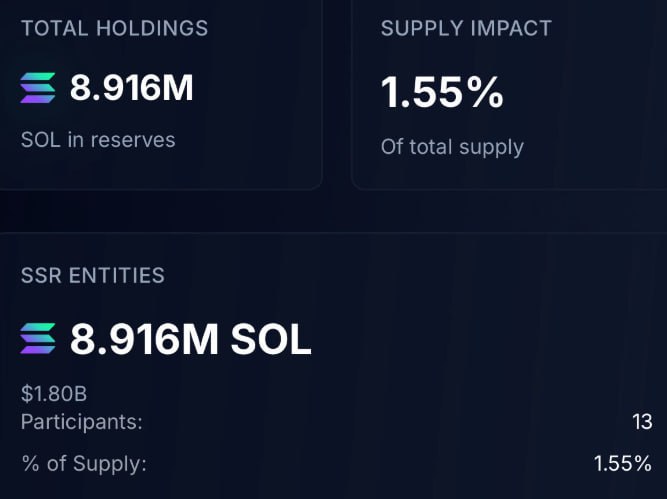

Thirteen publicly listed companies have now added $SOL to their balance sheets, treating it as a proper treasury management strategy. In total, they hold 8.91M $SOL — that’s around $1.8B today, representing about 1.55% of the entire circulating supply.

For me, this is another strong signal: Solana isn’t just a playground for degens and NFT artists anymore, it’s being considered by real businesses as a serious, long-term asset. When companies put their skin in the game like this, it shifts the narrative from hype to utility.

And honestly, I find it kinda beautiful — a chain that was once mocked for outages is now trusted by boardrooms. Comme quoi, persistence pays.

#Solana #CryptoTreasury #Blockchain #DeFi

Thirteen publicly listed companies have now added $SOL to their balance sheets, treating it as a proper treasury management strategy. In total, they hold 8.91M $SOL — that’s around $1.8B today, representing about 1.55% of the entire circulating supply.

For me, this is another strong signal: Solana isn’t just a playground for degens and NFT artists anymore, it’s being considered by real businesses as a serious, long-term asset. When companies put their skin in the game like this, it shifts the narrative from hype to utility.

And honestly, I find it kinda beautiful — a chain that was once mocked for outages is now trusted by boardrooms. Comme quoi, persistence pays.

#Solana #CryptoTreasury #Blockchain #DeFi

Disclaimer: This content is for informational purposes only and not financial advice.