SEC sniffs around crypto-heavy companies.

By Maxime Laurent · 2025-09-26 08:26

SEC sniffs around crypto-heavy companies.

According to WSJ, the SEC and FINRA are investigating stock activity of firms announcing plans to buy crypto.

The concern? Suspicious spikes in trading before the announcements. That smells like insider trading — when someone “in the know” front-runs the market, instead of letting all investors get the news at the same time. By the rules, material info must be released publicly, not whispered to a few lucky traders.

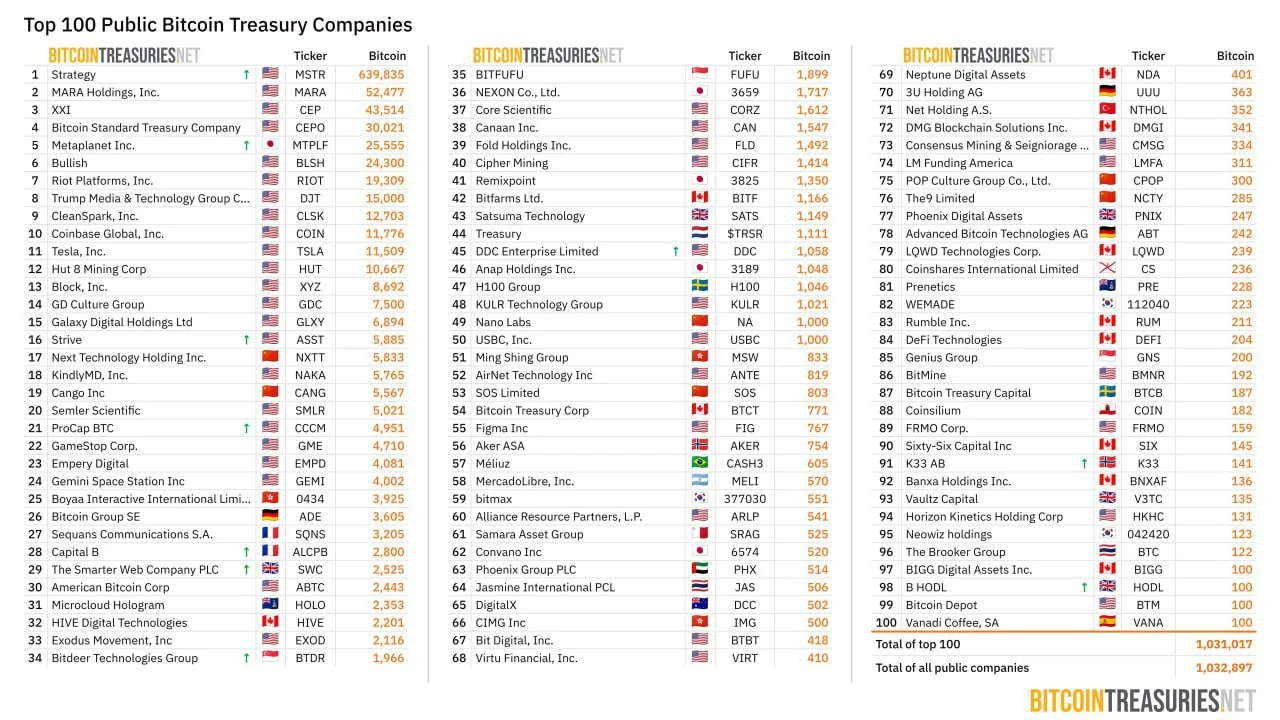

This whole trend started with Strategy, the OG corporate $BTC whale. Since then, more than 200 companies have hinted at putting over $100B into crypto. Naturally, Wall Street sharks circle whenever the word “Bitcoin” appears in a corporate balance sheet — but regulators now want to make sure the game isn’t rigged.

For me, it’s almost funny — in crypto we’re used to volatility and whales, but in the stock market, when boardroom leaks create mini-pumps, regulators jump in fast. C’est la vie. If anything, this shows how mainstream the “corporate Bitcoin play” has become: big enough to trigger SEC investigations.

In the end, I think the crackdown won’t kill the trend. If anything, it might push companies to be more transparent — which only makes the narrative of $BTC as a treasury asset even stronger. 🏦🔥

#BTC #Stocks #SEC #Regulation #Adoption

According to WSJ, the SEC and FINRA are investigating stock activity of firms announcing plans to buy crypto.

The concern? Suspicious spikes in trading before the announcements. That smells like insider trading — when someone “in the know” front-runs the market, instead of letting all investors get the news at the same time. By the rules, material info must be released publicly, not whispered to a few lucky traders.

This whole trend started with Strategy, the OG corporate $BTC whale. Since then, more than 200 companies have hinted at putting over $100B into crypto. Naturally, Wall Street sharks circle whenever the word “Bitcoin” appears in a corporate balance sheet — but regulators now want to make sure the game isn’t rigged.

For me, it’s almost funny — in crypto we’re used to volatility and whales, but in the stock market, when boardroom leaks create mini-pumps, regulators jump in fast. C’est la vie. If anything, this shows how mainstream the “corporate Bitcoin play” has become: big enough to trigger SEC investigations.

In the end, I think the crackdown won’t kill the trend. If anything, it might push companies to be more transparent — which only makes the narrative of $BTC as a treasury asset even stronger. 🏦🔥

#BTC #Stocks #SEC #Regulation #Adoption

Disclaimer: This content is for informational purposes only and not financial advice.