Oil money, now Bitcoin money.

By Maxime Laurent · 2026-02-20 10:22

Oil money, now Bitcoin money.

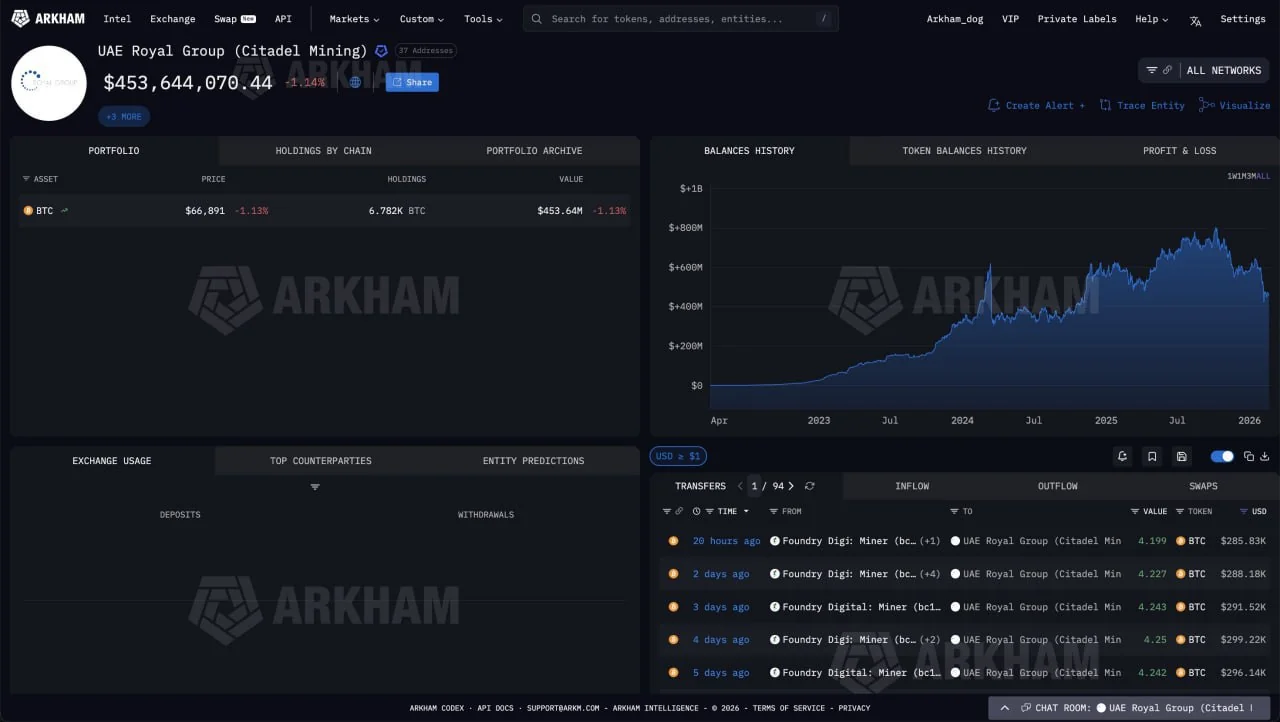

The UAE mined $454M in $BTC — and most of it hasn’t been sold.

This is the kind of headline that tells you nation-states are no longer just watching.

According to on-chain data flagged by Arkham, the United Arab Emirates, through partners including Citadel, has mined roughly $453.6 million worth of $BTC.

And here’s the key part:

The last major sales happened four months ago. Most of the coins are still being held.

If we exclude electricity costs, the estimated profit sits around $344 million.

That’s not small-scale experimentation. That’s industrial strategy.

Let’s zoom out.

Mining profitability depends heavily on:

– Energy cost

– Infrastructure scale

– Cooling efficiency

– Regulatory clarity

Regions with cheap and abundant energy still have a structural edge. And the UAE has both capital and access to energy resources.

So what does holding instead of selling suggest?

Possibly a sovereign-style accumulation strategy.

Not mining to dump.

Mining to stack.

When a country with deep pockets mines and holds $BTC, it signals long-term confidence — or at least long-term optionality.

It’s also geopolitically interesting.

Energy-rich nations are converting part of their resource advantage into digital scarcity. Oil into hash power. Hash power into bitcoin reserves.

From my terrace in the south of France, watching how countries compete not just in trade but in digital asset positioning… this feels like the next chapter.

First corporations stacked.

Now states optimize.

And mining in low-cost regions? Still very much alive.

Le jeu devient global. 🌍🔥

#Bitcoin #BTC #Mining #UAE #Crypto #DigitalAssets

The UAE mined $454M in $BTC — and most of it hasn’t been sold.

This is the kind of headline that tells you nation-states are no longer just watching.

According to on-chain data flagged by Arkham, the United Arab Emirates, through partners including Citadel, has mined roughly $453.6 million worth of $BTC.

And here’s the key part:

The last major sales happened four months ago. Most of the coins are still being held.

If we exclude electricity costs, the estimated profit sits around $344 million.

That’s not small-scale experimentation. That’s industrial strategy.

Let’s zoom out.

Mining profitability depends heavily on:

– Energy cost

– Infrastructure scale

– Cooling efficiency

– Regulatory clarity

Regions with cheap and abundant energy still have a structural edge. And the UAE has both capital and access to energy resources.

So what does holding instead of selling suggest?

Possibly a sovereign-style accumulation strategy.

Not mining to dump.

Mining to stack.

When a country with deep pockets mines and holds $BTC, it signals long-term confidence — or at least long-term optionality.

It’s also geopolitically interesting.

Energy-rich nations are converting part of their resource advantage into digital scarcity. Oil into hash power. Hash power into bitcoin reserves.

From my terrace in the south of France, watching how countries compete not just in trade but in digital asset positioning… this feels like the next chapter.

First corporations stacked.

Now states optimize.

And mining in low-cost regions? Still very much alive.

Le jeu devient global. 🌍🔥

#Bitcoin #BTC #Mining #UAE #Crypto #DigitalAssets

Disclaimer: This content is for informational purposes only and not financial advice.