MSCI threat puts MicroStrategy under pressure.

By Maxime Laurent · 2025-11-24 11:31

MSCI threat puts MicroStrategy under pressure.

JPMorgan report hints at index exclusions and $2.8B outflows.

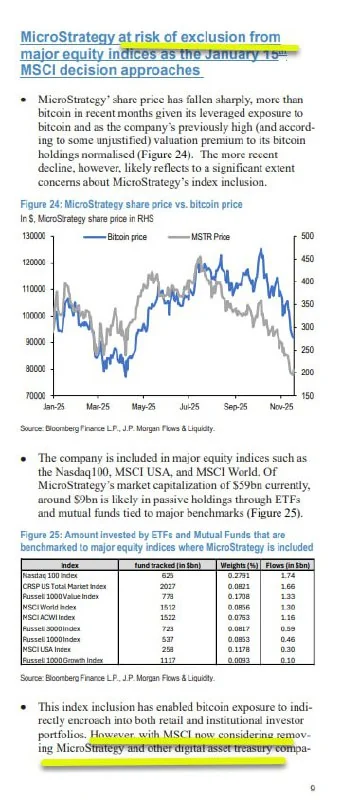

Caught this story while sipping my late-night café on the terrasse, and mon dieu, it’s causing some serious ripples. MSCI is considering removing companies that hold large amounts of $BTC from its indexes — and according to VanEck, that alone could trigger $2.8B in outflows for MicroStrategy. If other indexes follow, the total risk climbs to nearly $8.8B.

All of this flared up after a JPMorgan report, and the community reacted instantly — accusing the bank of pressuring DAT players and pulling liquidity en masse. It’s that classic crypto feeling: a Wall Street giant whispers, and the market jolts like it’s been shocked.

Michael Saylor, of course, fired back. He called the potential exclusion a mistake, reminding everyone that Strategy is not some passive $BTC vault — it’s an operating company with active business lines and digital debt instruments woven into its structure.

From my sunny southern corner, it’s wild to watch how quickly narratives turn. One minute MicroStrategy is the poster child of corporate Bitcoin conviction, the next it’s being painted as a risk factor for indexes. But that’s the game: when $BTC becomes part of traditional finance, the drama becomes very… tradfi.

Hold tight, mes amis — this fight is just beginning. 🌊🔥

#BTC #MicroStrategy #MSCI #JPMorgan #Saylor #CryptoFriture

JPMorgan report hints at index exclusions and $2.8B outflows.

Caught this story while sipping my late-night café on the terrasse, and mon dieu, it’s causing some serious ripples. MSCI is considering removing companies that hold large amounts of $BTC from its indexes — and according to VanEck, that alone could trigger $2.8B in outflows for MicroStrategy. If other indexes follow, the total risk climbs to nearly $8.8B.

All of this flared up after a JPMorgan report, and the community reacted instantly — accusing the bank of pressuring DAT players and pulling liquidity en masse. It’s that classic crypto feeling: a Wall Street giant whispers, and the market jolts like it’s been shocked.

Michael Saylor, of course, fired back. He called the potential exclusion a mistake, reminding everyone that Strategy is not some passive $BTC vault — it’s an operating company with active business lines and digital debt instruments woven into its structure.

From my sunny southern corner, it’s wild to watch how quickly narratives turn. One minute MicroStrategy is the poster child of corporate Bitcoin conviction, the next it’s being painted as a risk factor for indexes. But that’s the game: when $BTC becomes part of traditional finance, the drama becomes very… tradfi.

Hold tight, mes amis — this fight is just beginning. 🌊🔥

#BTC #MicroStrategy #MSCI #JPMorgan #Saylor #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.