Money printer back on turbo.

By Maxime Laurent · 2025-09-26 10:24

Money printer back on turbo.

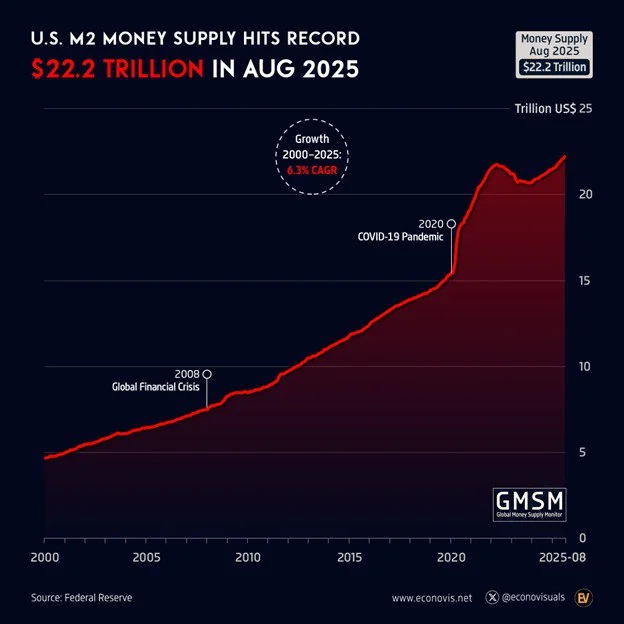

US M2 money supply hit $22.2T in August, growing +4.8% YoY — fastest pace since mid-2022.

For me, this is the eternal setup: $BTC vs. the dollar machine. On one side, fiat supply balloons endlessly; on the other, Bitcoin’s hard cap sits immovable at 21M. Every time M2 accelerates like this, it feels like a neon sign flashing: “scarcity matters.”

The consequences are pretty clear:

🔹 Rising M2 beyond real growth = higher inflation risk. That pushes smart money into hedges — gold, real estate… and increasingly, $BTC.

🔹 As trust in the dollar weakens, investors look for assets that can’t be “printed.” Bitcoin fits that role perfectly, digital gold with no central banker at the helm.

🔹 Long-term, more M2 usually translates into more liquidity sloshing around, and some of it inevitably spills into crypto markets.

But — and here’s the nuance — if the Fed suddenly flips hawkish, cranking rates and squeezing liquidity, that same $BTC can take a beating in the short term. Risk assets bleed when dollars get tighter.

So, I see it like the Mediterranean sea in autumn: calm surface, but undercurrents shifting fast. Long run, money supply growth is pure fuel for Bitcoin’s store-of-value thesis. Short run, Fed policy can still crash the party. 🌊🔥

#BTC #Macro #Inflation #M2 #HardMoney

US M2 money supply hit $22.2T in August, growing +4.8% YoY — fastest pace since mid-2022.

For me, this is the eternal setup: $BTC vs. the dollar machine. On one side, fiat supply balloons endlessly; on the other, Bitcoin’s hard cap sits immovable at 21M. Every time M2 accelerates like this, it feels like a neon sign flashing: “scarcity matters.”

The consequences are pretty clear:

🔹 Rising M2 beyond real growth = higher inflation risk. That pushes smart money into hedges — gold, real estate… and increasingly, $BTC.

🔹 As trust in the dollar weakens, investors look for assets that can’t be “printed.” Bitcoin fits that role perfectly, digital gold with no central banker at the helm.

🔹 Long-term, more M2 usually translates into more liquidity sloshing around, and some of it inevitably spills into crypto markets.

But — and here’s the nuance — if the Fed suddenly flips hawkish, cranking rates and squeezing liquidity, that same $BTC can take a beating in the short term. Risk assets bleed when dollars get tighter.

So, I see it like the Mediterranean sea in autumn: calm surface, but undercurrents shifting fast. Long run, money supply growth is pure fuel for Bitcoin’s store-of-value thesis. Short run, Fed policy can still crash the party. 🌊🔥

#BTC #Macro #Inflation #M2 #HardMoney

Disclaimer: This content is for informational purposes only and not financial advice.