Metals are screaming, not whispering anymore.

By Maxime Laurent · 2026-01-29 08:32

Metals are screaming, not whispering anymore.

Gold and silver keep smashing records — and the scale of the move is what really matters.

Silver just printed a new all-time high around $120. In only 29 days, it delivered a return four times higher than the S&P 500 did in all of 2025. That’s not a trade — that’s a statement.

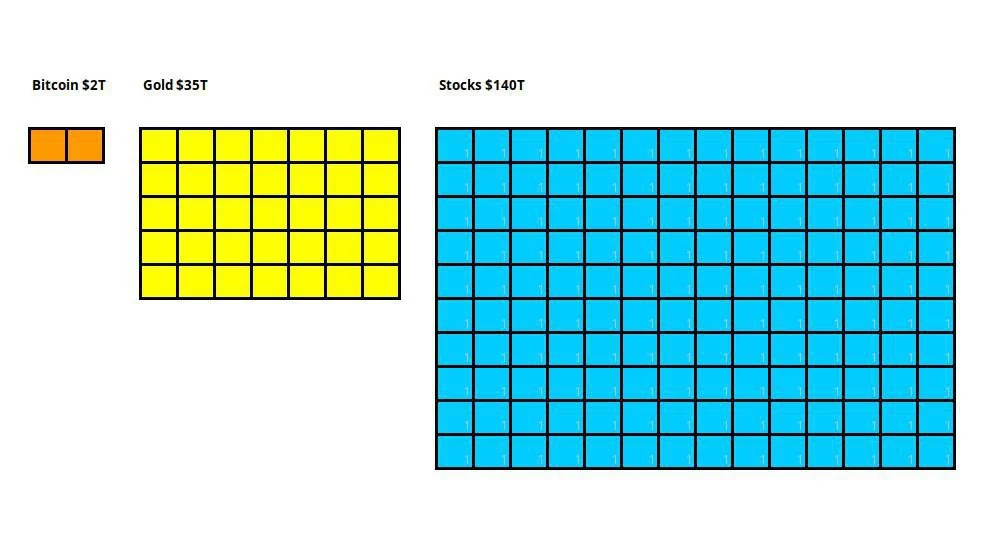

Gold is even more absurd. In a single day, its market cap jumped by roughly $2.2 trillion, now sitting near $35T. For perspective, total $BTC market cap is around $1.8T. When gold moves “just $100”, it’s not pocket change — it’s trillions of liquidity shifting hands.

This is where people get confused. They see a small price change and underestimate the violence of the move. But big markets don’t need big percentages to dominate the room. They just lean slightly… and everything else feels it.

To me, this smells like classic late-cycle behavior. Capital crowds into assets with history, depth, and perceived safety. No narratives, no promises — just weight. Silver adds spice because it’s thinner, more emotional, more explosive.

Crypto folks should pay attention, not panic. When metals absorb this much capital, it doesn’t disappear. It waits. And eventually, it looks for asymmetry again. That’s usually where $BTC enters the conversation.

For now, the old kings are reminding everyone how big they really are. Impressionnant.

#gold #silver #macro #markets #bitcoin #BTC #liquidity #CryptoFriture

Gold and silver keep smashing records — and the scale of the move is what really matters.

Silver just printed a new all-time high around $120. In only 29 days, it delivered a return four times higher than the S&P 500 did in all of 2025. That’s not a trade — that’s a statement.

Gold is even more absurd. In a single day, its market cap jumped by roughly $2.2 trillion, now sitting near $35T. For perspective, total $BTC market cap is around $1.8T. When gold moves “just $100”, it’s not pocket change — it’s trillions of liquidity shifting hands.

This is where people get confused. They see a small price change and underestimate the violence of the move. But big markets don’t need big percentages to dominate the room. They just lean slightly… and everything else feels it.

To me, this smells like classic late-cycle behavior. Capital crowds into assets with history, depth, and perceived safety. No narratives, no promises — just weight. Silver adds spice because it’s thinner, more emotional, more explosive.

Crypto folks should pay attention, not panic. When metals absorb this much capital, it doesn’t disappear. It waits. And eventually, it looks for asymmetry again. That’s usually where $BTC enters the conversation.

For now, the old kings are reminding everyone how big they really are. Impressionnant.

#gold #silver #macro #markets #bitcoin #BTC #liquidity #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.