Market Review: When selling turns into fleeing.

By Maxime Laurent · 2026-02-02 09:07

Market Review: When selling turns into fleeing.

Price, liquidations, and psychology are breaking at once — classic deep-clean phase.

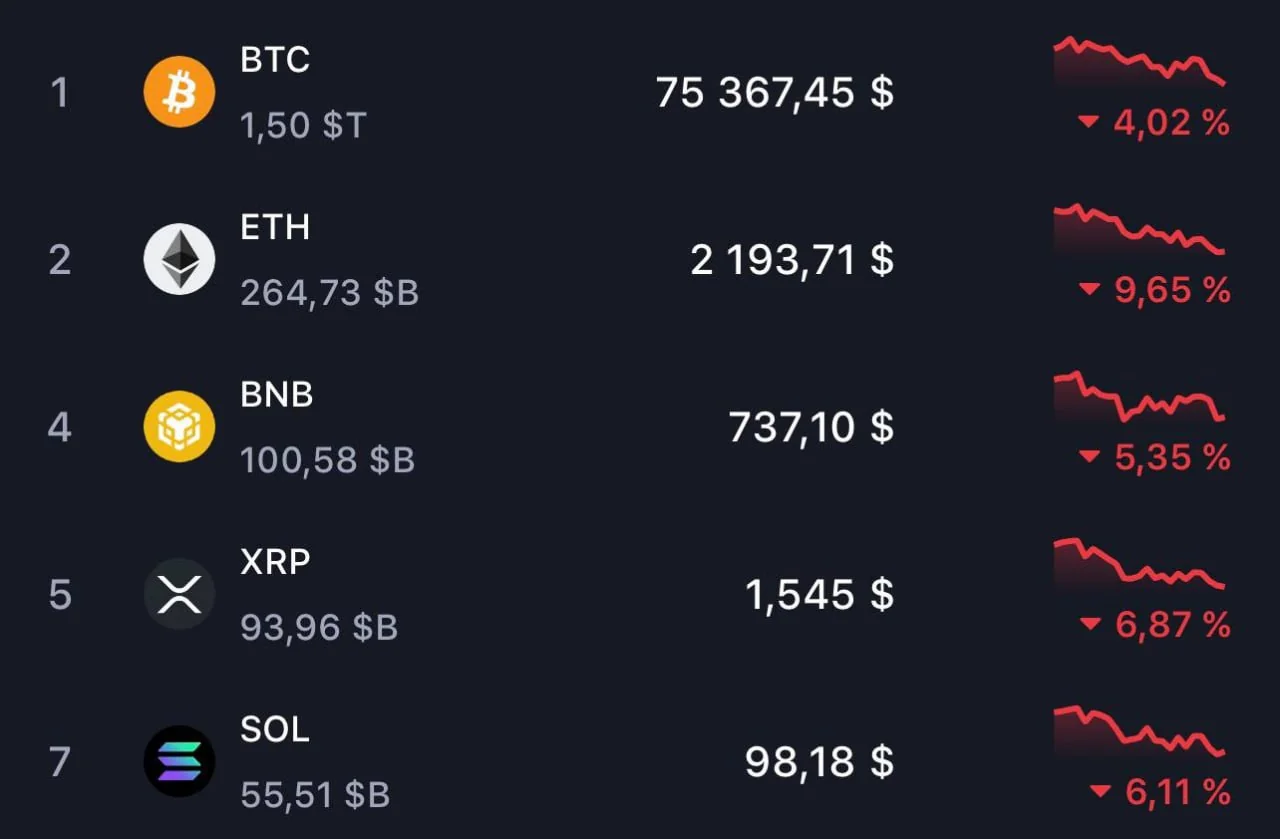

February 2nd, and the market feels heavy. $BTC slipped below the average buy price of Strategy — under $76,000 — putting them at roughly $900M unrealized loss. Spot price sits around $75,300, down -4% on the day, marking four red monthly closes in a row for the first time since 2018. That alone tells you how rare this setup is.

Liquidations didn’t help. Over the last 24h, about $761.5M got wiped, mostly longs ($587.5M). This isn’t traders changing their mind — it’s positions being forced out. The market is shrinking leverage the brutal way.

But the real damage is psychological. Sentiment is among the darkest we’ve seen in years. People say it feels worse than Luna, FTX, 2018, even the Covid crash. That’s important: markets don’t move on facts alone, they move on pain thresholds.

Even big names aren’t spared. Bitmine Immersion, linked to Tom Lee, is sitting on a $6.7B unrealized loss in $ETH (-43%). When institutions bleed quietly, you know we’re deep in the cleanse.

Bottom line? Pressure everywhere — price, liquidations, minds. Historically, these ugly phases matter. They don’t feel like opportunity when you’re inside them… but that’s often the point. Marché rincé. 🫠

#bitcoin #crypto #markets #sentiment #liquidations #btc #eth #macro

Price, liquidations, and psychology are breaking at once — classic deep-clean phase.

February 2nd, and the market feels heavy. $BTC slipped below the average buy price of Strategy — under $76,000 — putting them at roughly $900M unrealized loss. Spot price sits around $75,300, down -4% on the day, marking four red monthly closes in a row for the first time since 2018. That alone tells you how rare this setup is.

Liquidations didn’t help. Over the last 24h, about $761.5M got wiped, mostly longs ($587.5M). This isn’t traders changing their mind — it’s positions being forced out. The market is shrinking leverage the brutal way.

But the real damage is psychological. Sentiment is among the darkest we’ve seen in years. People say it feels worse than Luna, FTX, 2018, even the Covid crash. That’s important: markets don’t move on facts alone, they move on pain thresholds.

Even big names aren’t spared. Bitmine Immersion, linked to Tom Lee, is sitting on a $6.7B unrealized loss in $ETH (-43%). When institutions bleed quietly, you know we’re deep in the cleanse.

Bottom line? Pressure everywhere — price, liquidations, minds. Historically, these ugly phases matter. They don’t feel like opportunity when you’re inside them… but that’s often the point. Marché rincé. 🫠

#bitcoin #crypto #markets #sentiment #liquidations #btc #eth #macro

Disclaimer: This content is for informational purposes only and not financial advice.