Leverage reshapes the crypto game.

By Maxime Laurent · 2025-12-11 08:26

Leverage reshapes the crypto game.

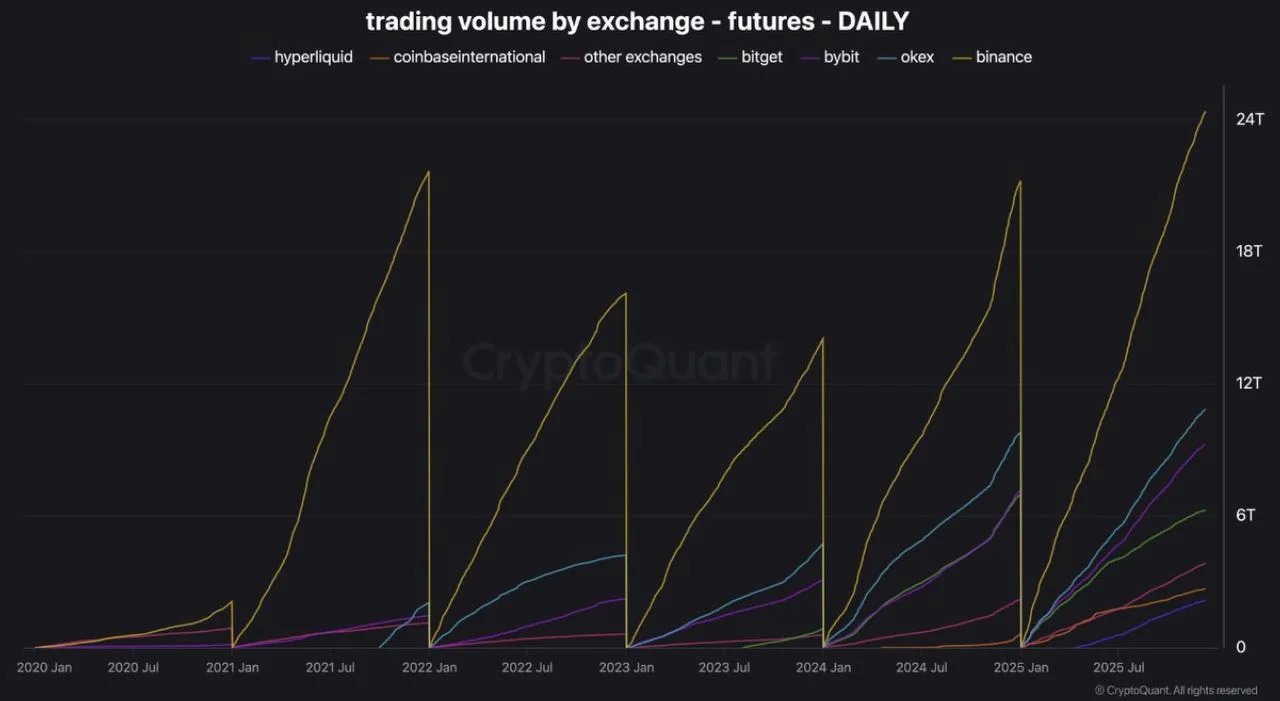

Derivatives dominate in 2025, making the $BTC market fragile and hyper-reactive.

CryptoQuant just dropped a truth bomb, and it hits harder than the mistral on a bad hair day. Leverage and futures have totally rewritten the rules of the 2025 market — and not in a cozy, predictable way.

Trading volumes in derivatives are at historic highs, and that means one thing: the market runs not on real coin demand, but on speculative capital ready to snap like dry wood.

We’ve entered a phase where cascading liquidations and domino effects dictate price action.

You saw it on October 10 — support levels weren’t “levels” anymore, they were trapdoors. One big unwind, and the whole structure wobbles. Eh oui, that’s our new reality.

What makes it even spicier is the rise of decentralized futures markets that hide positions from prying eyes, plus the layering of institutional strategies that amplify volatility.

The result? A market that’s mechanically more fragile, quicker to move, quicker to break, and quicker to surprise.

From my sunny southern balcony, I can feel that tension — like everyone’s surfing a giant wave, hoping it doesn’t fold into a wipeout 🌊⚡️

#Bitcoin #BTC #Derivatives #Leverage #Futures #CryptoMarket #CryptoQuant

Derivatives dominate in 2025, making the $BTC market fragile and hyper-reactive.

CryptoQuant just dropped a truth bomb, and it hits harder than the mistral on a bad hair day. Leverage and futures have totally rewritten the rules of the 2025 market — and not in a cozy, predictable way.

Trading volumes in derivatives are at historic highs, and that means one thing: the market runs not on real coin demand, but on speculative capital ready to snap like dry wood.

We’ve entered a phase where cascading liquidations and domino effects dictate price action.

You saw it on October 10 — support levels weren’t “levels” anymore, they were trapdoors. One big unwind, and the whole structure wobbles. Eh oui, that’s our new reality.

What makes it even spicier is the rise of decentralized futures markets that hide positions from prying eyes, plus the layering of institutional strategies that amplify volatility.

The result? A market that’s mechanically more fragile, quicker to move, quicker to break, and quicker to surprise.

From my sunny southern balcony, I can feel that tension — like everyone’s surfing a giant wave, hoping it doesn’t fold into a wipeout 🌊⚡️

#Bitcoin #BTC #Derivatives #Leverage #Futures #CryptoMarket #CryptoQuant

Disclaimer: This content is for informational purposes only and not financial advice.