Institutions are going all-in on Bitcoin.

By Maxime Laurent · 2026-01-15 16:55

Institutions are going all-in on Bitcoin.

In just two weeks, institutions bought 6× more $BTC than miners produced, pushing the market toward a supply squeeze.

January barely started, and already you can feel the tension in the air.

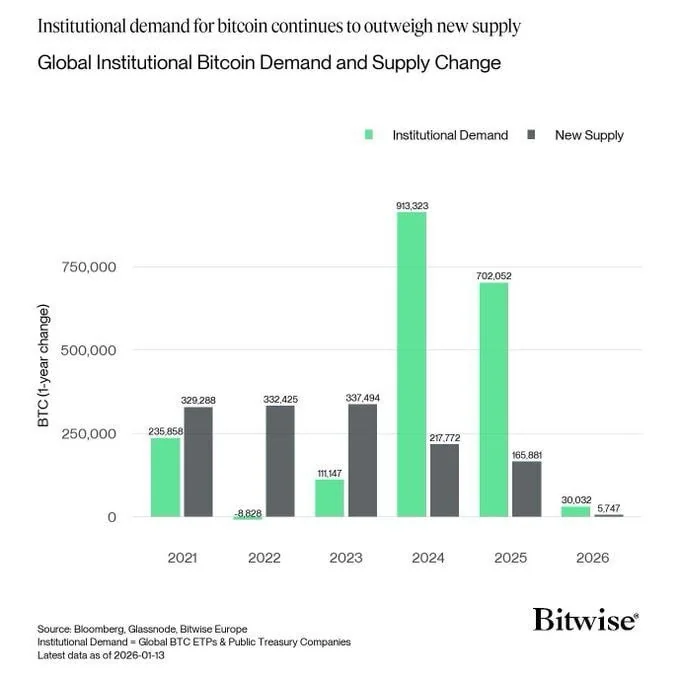

In just two weeks, institutional players scooped up around 30,000 $BTC, while miners produced only 5,700. That’s not accumulation — that’s absorption. Quiet, methodical, almost surgical.

Zoom out a bit. In 2025, institutions bought 4.23× more Bitcoin than miners mined. In 2024, it was 4.19×. Same story, getting louder. Supply is fixed, issuance keeps shrinking, and demand? It’s not asking for permission anymore.

This is the part retail often misses. Institutions don’t chase candles. They front-run scarcity. They look at flows, not feelings. When big money starts eating future supply today, something breaks eventually — usually the price ceiling.

If this pace holds, the market isn’t debating if a supply shock comes, but when. And when supply tightens on an asset like $BTC… well, you know how that movie ends. Ça sent la pénurie.

I stay calm, coffee in hand, watching the tide come in. 🌊

#Bitcoin #BTC #institutions #scarcity #mining #crypto #CryptoFriture

In just two weeks, institutions bought 6× more $BTC than miners produced, pushing the market toward a supply squeeze.

January barely started, and already you can feel the tension in the air.

In just two weeks, institutional players scooped up around 30,000 $BTC, while miners produced only 5,700. That’s not accumulation — that’s absorption. Quiet, methodical, almost surgical.

Zoom out a bit. In 2025, institutions bought 4.23× more Bitcoin than miners mined. In 2024, it was 4.19×. Same story, getting louder. Supply is fixed, issuance keeps shrinking, and demand? It’s not asking for permission anymore.

This is the part retail often misses. Institutions don’t chase candles. They front-run scarcity. They look at flows, not feelings. When big money starts eating future supply today, something breaks eventually — usually the price ceiling.

If this pace holds, the market isn’t debating if a supply shock comes, but when. And when supply tightens on an asset like $BTC… well, you know how that movie ends. Ça sent la pénurie.

I stay calm, coffee in hand, watching the tide come in. 🌊

#Bitcoin #BTC #institutions #scarcity #mining #crypto #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.