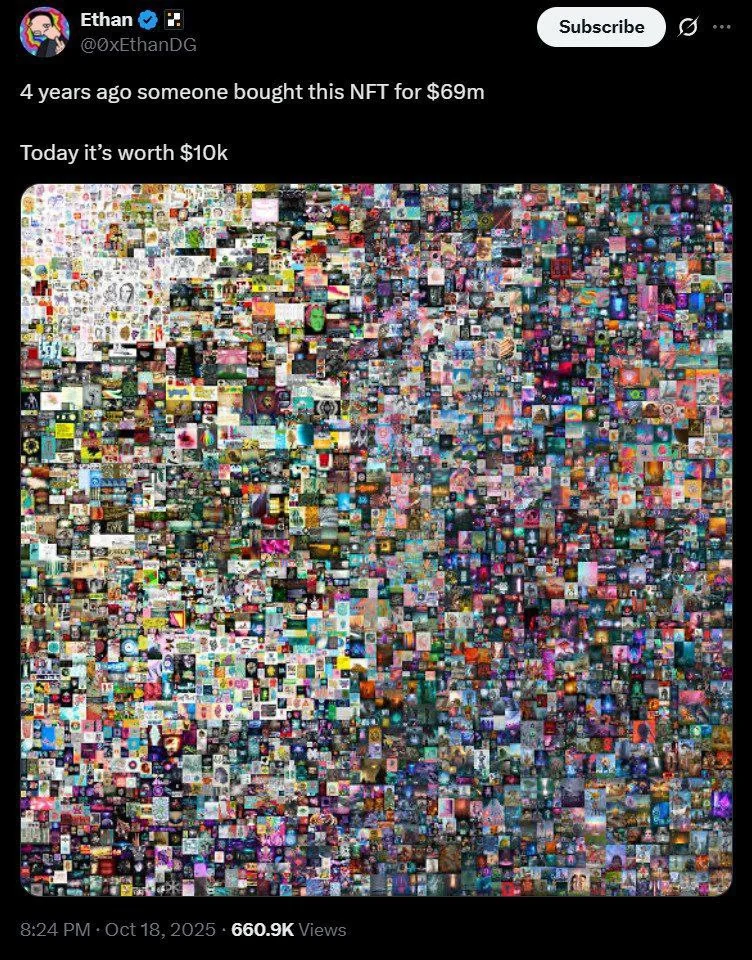

How to turn $69M into $10K.

By Maxime Laurent · 2025-10-20 09:26

How to turn $69M into $10K.

A short explainer: why a $69M NFT can resurface at $10K, and the shady mechanisms behind the headlines.

Alright, sit with me on the terrace — this one smells like seaside gossip mixed with cold math. Four years ago a JPEG sold for $69,000,000; today a listing shows it for $10,000 and people are already laughing. But before we pop the champagne, let’s peel the onion. 🧅

First — headlines lie. An NFT listing at $10K doesn’t automatically mean the market corrected that specific buyer’s investment. Prices can reflect fractional sales, relists by different wallets, or simply a token that the original owner moved into a different address. Sometimes it’s theater, not reality.

Second — two common schemes that explain the “magic” of turning massive sums into tiny-looking prices:

Tax optimization via collectibles. In many jurisdictions NFTs are treated as collectibles or property with special rules. Instead of selling crypto (taxed as capital gains), some people route value through NFTs, structure transfers between related parties, or exploit gaps in regulation to reduce taxes. ⚖️🧾 This isn’t universal, and it’s not always legal — but it’s a reason a multimillion-dollar buyer might quietly unwind exposure without a public market panic.

Money laundering through mint-and-sell. A shady but real play: mint something, have controlled parties “buy” it with dirty funds, then move that value around as seemingly legit sales. On-chain records look clean; off-chain reality is not. That’s why regulators and exchanges keep one eye on provenance and wash-sale patterns. 🔒💸

There are more moves — wash trading to pump perceived value, coordinated relists to confuse trackers, or even NFTs used as collateral or accounting tools inside complex corporate structures. The point? A low asking price on a marketplace screenshot is rarely the whole story. ça alors — things are often messier than they look.

If you’re following these stories as a trader or collector: stay skeptical, check provenance and on-chain history, and remember taxes and compliance are real costs. Better to be boring-and-legal than flashy-and-risky. I prefer my portfolio like my rosé — dry, honest, and good in the sun. 😎🌊

#NFT #Crypto #Tax #AML #ArtMarket #CryptoFriture

A short explainer: why a $69M NFT can resurface at $10K, and the shady mechanisms behind the headlines.

Alright, sit with me on the terrace — this one smells like seaside gossip mixed with cold math. Four years ago a JPEG sold for $69,000,000; today a listing shows it for $10,000 and people are already laughing. But before we pop the champagne, let’s peel the onion. 🧅

First — headlines lie. An NFT listing at $10K doesn’t automatically mean the market corrected that specific buyer’s investment. Prices can reflect fractional sales, relists by different wallets, or simply a token that the original owner moved into a different address. Sometimes it’s theater, not reality.

Second — two common schemes that explain the “magic” of turning massive sums into tiny-looking prices:

Tax optimization via collectibles. In many jurisdictions NFTs are treated as collectibles or property with special rules. Instead of selling crypto (taxed as capital gains), some people route value through NFTs, structure transfers between related parties, or exploit gaps in regulation to reduce taxes. ⚖️🧾 This isn’t universal, and it’s not always legal — but it’s a reason a multimillion-dollar buyer might quietly unwind exposure without a public market panic.

Money laundering through mint-and-sell. A shady but real play: mint something, have controlled parties “buy” it with dirty funds, then move that value around as seemingly legit sales. On-chain records look clean; off-chain reality is not. That’s why regulators and exchanges keep one eye on provenance and wash-sale patterns. 🔒💸

There are more moves — wash trading to pump perceived value, coordinated relists to confuse trackers, or even NFTs used as collateral or accounting tools inside complex corporate structures. The point? A low asking price on a marketplace screenshot is rarely the whole story. ça alors — things are often messier than they look.

If you’re following these stories as a trader or collector: stay skeptical, check provenance and on-chain history, and remember taxes and compliance are real costs. Better to be boring-and-legal than flashy-and-risky. I prefer my portfolio like my rosé — dry, honest, and good in the sun. 😎🌊

#NFT #Crypto #Tax #AML #ArtMarket #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.