Gold goes on-chain, seriously.

By Maxime Laurent · 2026-02-17 13:53

Gold goes on-chain, seriously.

Wintermute opens OTC for tokenized gold as volumes explode past major gold ETFs.

This is one of those moments where TradFi and crypto stop flirting and actually start building bridges.

Wintermute just launched institutional OTC trading for tokenized gold — specifically PAXG and XAUT.

Quiet headline. Massive implication.

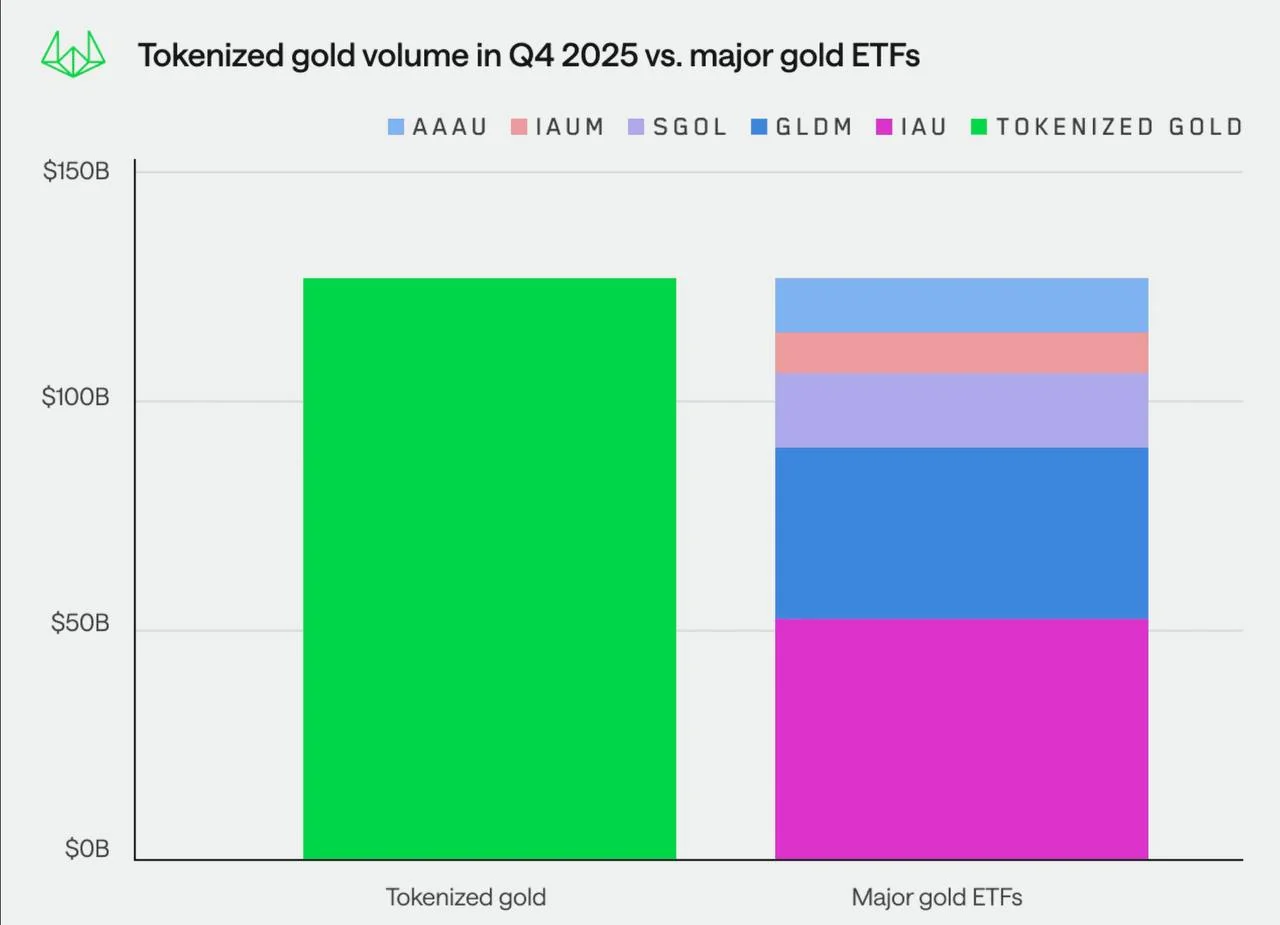

In Q4 2025 alone, tokenized gold trading volume reportedly hit $126B, surpassing the combined volume of the five largest traditional gold ETFs.

Let that sink in.

Physical gold exposure — but 24/7, on-chain, transferable like $ETH, usable in DeFi, collateral-ready.

That’s not a narrative experiment anymore. That’s infrastructure.

Tokenized gold like

PAX Gold (PAXG) and

Tether Gold (XAUT)

represents real, vaulted gold — but wrapped in blockchain rails.

Why does OTC matter?

Because institutions don’t trade size on public order books. They use OTC desks to move serious capital without slippage. If Wintermute is opening that lane, it means demand is institutional-scale.

And according to CEO Evgeny Gaevoy, this segment could grow 2.8x by 2026 — from $5.4B to $15B market cap.

Now zoom out.

We’re watching three parallel monetary narratives:

– $BTC as digital scarcity

– Stablecoins as digital dollars

– Tokenized gold as digital hard asset hedge

This is the fusion of centuries-old safe haven logic with programmable finance.

And honestly? It makes sense.

In uncertain macro cycles, some investors don’t want volatility. They want gold. But they also want mobility, speed, collateral efficiency.

On-chain gold solves that.

From my little Mediterranean corner, this feels like the next stage of crypto maturity. Not just rebellion — integration.

Gold isn’t leaving vaults.

It’s getting a wallet.

C’est élégant, non? ✨

#Crypto #Tokenization #Gold #PAXG #XAUT #Bitcoin #OTC

Wintermute opens OTC for tokenized gold as volumes explode past major gold ETFs.

This is one of those moments where TradFi and crypto stop flirting and actually start building bridges.

Wintermute just launched institutional OTC trading for tokenized gold — specifically PAXG and XAUT.

Quiet headline. Massive implication.

In Q4 2025 alone, tokenized gold trading volume reportedly hit $126B, surpassing the combined volume of the five largest traditional gold ETFs.

Let that sink in.

Physical gold exposure — but 24/7, on-chain, transferable like $ETH, usable in DeFi, collateral-ready.

That’s not a narrative experiment anymore. That’s infrastructure.

Tokenized gold like

PAX Gold (PAXG) and

Tether Gold (XAUT)

represents real, vaulted gold — but wrapped in blockchain rails.

Why does OTC matter?

Because institutions don’t trade size on public order books. They use OTC desks to move serious capital without slippage. If Wintermute is opening that lane, it means demand is institutional-scale.

And according to CEO Evgeny Gaevoy, this segment could grow 2.8x by 2026 — from $5.4B to $15B market cap.

Now zoom out.

We’re watching three parallel monetary narratives:

– $BTC as digital scarcity

– Stablecoins as digital dollars

– Tokenized gold as digital hard asset hedge

This is the fusion of centuries-old safe haven logic with programmable finance.

And honestly? It makes sense.

In uncertain macro cycles, some investors don’t want volatility. They want gold. But they also want mobility, speed, collateral efficiency.

On-chain gold solves that.

From my little Mediterranean corner, this feels like the next stage of crypto maturity. Not just rebellion — integration.

Gold isn’t leaving vaults.

It’s getting a wallet.

C’est élégant, non? ✨

#Crypto #Tokenization #Gold #PAXG #XAUT #Bitcoin #OTC

Disclaimer: This content is for informational purposes only and not financial advice.