From mockery to mass hiring: banks embrace crypto.

By Maxime Laurent · 2026-02-16 09:41

From mockery to mass hiring: banks embrace crypto.

Banks once calling crypto a scam now fight for blockchain talent and build serious digital asset teams.

I still remember 2017. I was watching $BTC on my tiny laptop in a café by the port, and every TV “expert” was laughing. “Scam.” “Ponzi.” “Criminal money.” Fast forward to today — and voilà, the same institutions are opening crypto desks and hunting blockchain talent like it’s the last baguette before sunset.

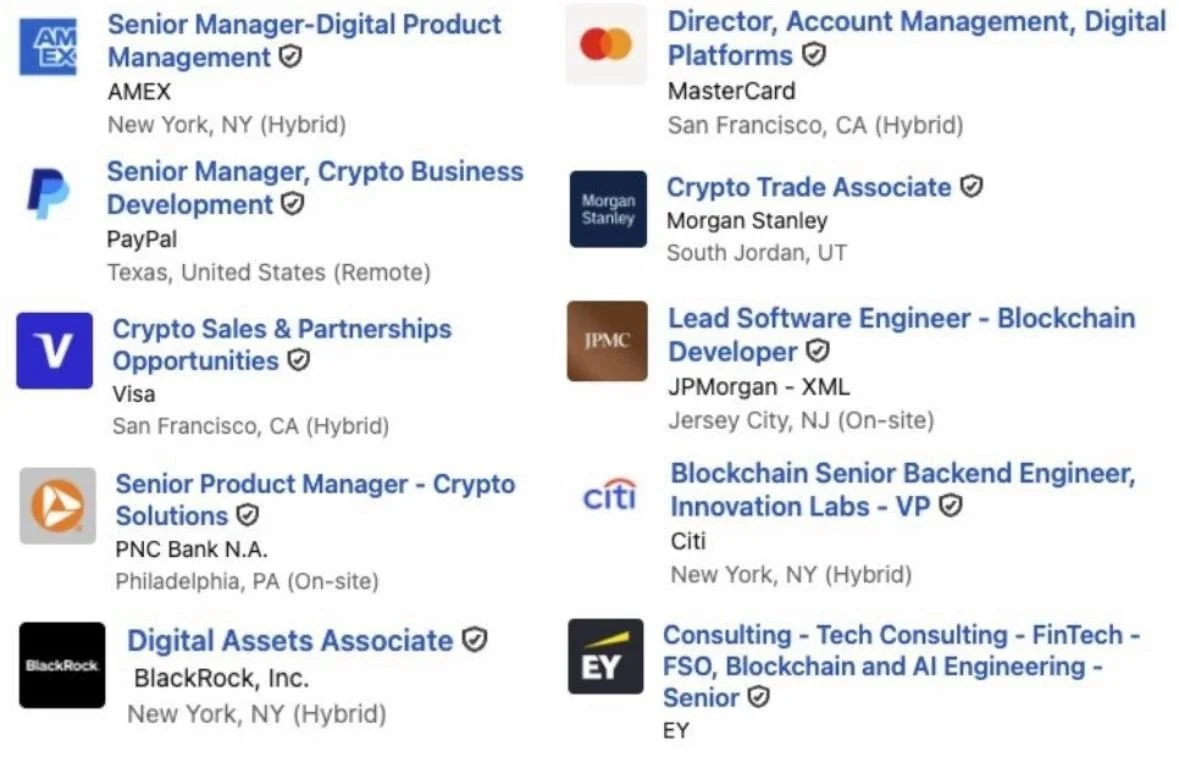

AMEX, PayPal, Visa, JPMorgan, Morgan Stanley, BlackRock, Citi… they’re not just experimenting anymore. They’re recruiting product leads, on-chain analysts, traders, engineers. Real budgets. Real teams. Real strategy.

What changed? Not the code. Not the philosophy. The paradigm.

The ETFs around $BTC normalized exposure. Institutional custody matured. Stablecoins became serious liquidity rails. And suddenly, ignoring crypto became riskier than embracing it. When BlackRock starts talking about tokenization like it’s the future of capital markets, you know we’ve crossed a psychological line.

For me, this is not about “number go up.” It’s about validation. Years of volatility, memes, bear markets, and now the suits want in. Ça y est — the narrative flipped.

But here’s the nuance: institutions entering doesn’t mean crypto loses its soul. It means the battlefield changes. Retail degens, builders, funds, banks — we’re all in the same arena now. The question is: who adapts faster?

If you’re still early in this space, don’t underestimate what’s happening. When giants compete for blockchain talent, it’s not a trend. It’s infrastructure forming under our feet.

And infrastructure is where real wealth cycles are born. 🌊🔥

#Crypto #BTC #ETH #Blockchain #Web3 #InstitutionalAdoption

Banks once calling crypto a scam now fight for blockchain talent and build serious digital asset teams.

I still remember 2017. I was watching $BTC on my tiny laptop in a café by the port, and every TV “expert” was laughing. “Scam.” “Ponzi.” “Criminal money.” Fast forward to today — and voilà, the same institutions are opening crypto desks and hunting blockchain talent like it’s the last baguette before sunset.

AMEX, PayPal, Visa, JPMorgan, Morgan Stanley, BlackRock, Citi… they’re not just experimenting anymore. They’re recruiting product leads, on-chain analysts, traders, engineers. Real budgets. Real teams. Real strategy.

What changed? Not the code. Not the philosophy. The paradigm.

The ETFs around $BTC normalized exposure. Institutional custody matured. Stablecoins became serious liquidity rails. And suddenly, ignoring crypto became riskier than embracing it. When BlackRock starts talking about tokenization like it’s the future of capital markets, you know we’ve crossed a psychological line.

For me, this is not about “number go up.” It’s about validation. Years of volatility, memes, bear markets, and now the suits want in. Ça y est — the narrative flipped.

But here’s the nuance: institutions entering doesn’t mean crypto loses its soul. It means the battlefield changes. Retail degens, builders, funds, banks — we’re all in the same arena now. The question is: who adapts faster?

If you’re still early in this space, don’t underestimate what’s happening. When giants compete for blockchain talent, it’s not a trend. It’s infrastructure forming under our feet.

And infrastructure is where real wealth cycles are born. 🌊🔥

#Crypto #BTC #ETH #Blockchain #Web3 #InstitutionalAdoption

Disclaimer: This content is for informational purposes only and not financial advice.