From $10K doom to $28K doubt.

By Maxime Laurent · 2026-02-20 10:23

From $10K doom to $28K doubt.

Bloomberg’s Mike McGlone softens his $BTC crash call — but stays skeptical.

Markets don’t just move. Narratives move with them.

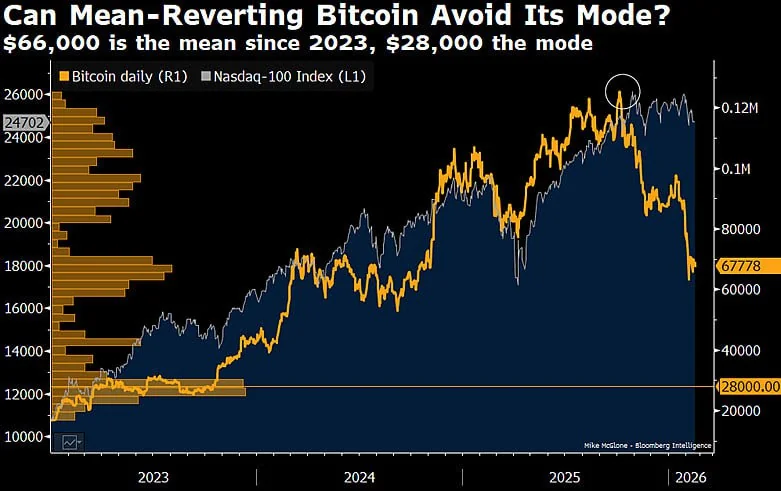

Mike McGlone from Bloomberg Intelligence has revised his previous call that $BTC could fall to $10,000.

After criticism and pushback, he adjusted the downside “target” to around $28,000.

That’s… a significant difference.

Earlier, he framed the potential collapse as part of a broader cycle unwind — macro tightening, risk asset cooling, speculative excess getting flushed. A classic “stress test” for crypto.

Now, the tone is softer — but still cautious.

And here’s what I find interesting:

When prominent analysts lower extreme bearish targets upward, it often reflects changing market structure, not just social pressure.

Think about it.

The $10K scenario implied:

– Severe liquidity contraction

– Major institutional exit

– Deep global risk-off environment

But today’s crypto landscape includes:

– Spot ETFs

– Corporate treasuries holding $BTC

– Nation-state mining strategies

– More mature derivatives markets

That doesn’t make Bitcoin immune.

It just makes 2026 structurally different from 2018.

Macro still matters. If global markets cool aggressively, speculative assets feel it first. $BTC is still correlated to liquidity cycles. Anyone pretending otherwise is ignoring history.

But here’s my personal take, sitting by the Mediterranean with the wind calm and charts open:

Bearish narratives get attention.

Extremely bearish narratives get headlines.

But markets rarely follow linear predictions.

They overshoot. Both ways.

From $69K to $15K once felt like the end.

Now $28K is called a stress test.

Perspective is everything.

And in crypto, conviction is built in volatility — not in consensus forecasts.

On verra bien. 🌊🔥

#Bitcoin #BTC #Bloomberg #Markets #Crypto #Macro

Bloomberg’s Mike McGlone softens his $BTC crash call — but stays skeptical.

Markets don’t just move. Narratives move with them.

Mike McGlone from Bloomberg Intelligence has revised his previous call that $BTC could fall to $10,000.

After criticism and pushback, he adjusted the downside “target” to around $28,000.

That’s… a significant difference.

Earlier, he framed the potential collapse as part of a broader cycle unwind — macro tightening, risk asset cooling, speculative excess getting flushed. A classic “stress test” for crypto.

Now, the tone is softer — but still cautious.

And here’s what I find interesting:

When prominent analysts lower extreme bearish targets upward, it often reflects changing market structure, not just social pressure.

Think about it.

The $10K scenario implied:

– Severe liquidity contraction

– Major institutional exit

– Deep global risk-off environment

But today’s crypto landscape includes:

– Spot ETFs

– Corporate treasuries holding $BTC

– Nation-state mining strategies

– More mature derivatives markets

That doesn’t make Bitcoin immune.

It just makes 2026 structurally different from 2018.

Macro still matters. If global markets cool aggressively, speculative assets feel it first. $BTC is still correlated to liquidity cycles. Anyone pretending otherwise is ignoring history.

But here’s my personal take, sitting by the Mediterranean with the wind calm and charts open:

Bearish narratives get attention.

Extremely bearish narratives get headlines.

But markets rarely follow linear predictions.

They overshoot. Both ways.

From $69K to $15K once felt like the end.

Now $28K is called a stress test.

Perspective is everything.

And in crypto, conviction is built in volatility — not in consensus forecasts.

On verra bien. 🌊🔥

#Bitcoin #BTC #Bloomberg #Markets #Crypto #Macro

Disclaimer: This content is for informational purposes only and not financial advice.