Crypto Is Officially on the Government Radar.

By Maxime Laurent · 2026-01-05 13:07

Crypto Is Officially on the Government Radar.

From 2026, 48 countries start tracking crypto activity under CARF, with data sharing between tax authorities coming next.

I read this news with the same feeling you get when the sea suddenly goes flat — calm, but you know something big just shifted under the surface 🌊

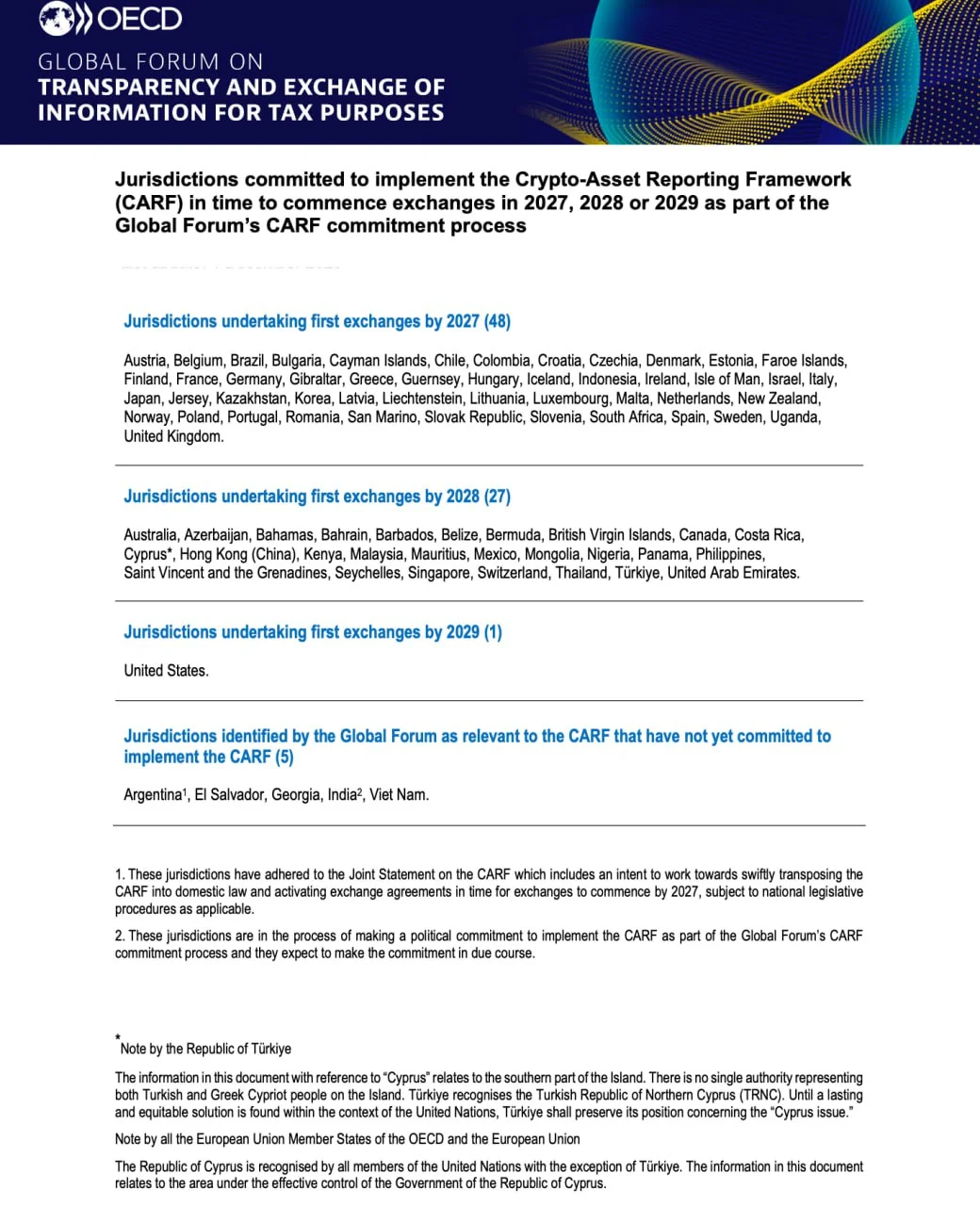

As of January 1, 2026, the Crypto-Asset Reporting Framework, developed under the umbrella of the OECD, is now live in 48 countries. This year is about collecting data. In 2027, governments start exchanging it with each other.

Who’s concerned? Pretty much everyone with a bridge to fiat:

Centralized exchanges

Some DeFi platforms

Crypto ATMs

Brokers and custodians

The goal is clear: reduce tax evasion and money laundering. No drama, no ideology — just states doing what states always do when something gets big.

What’s interesting is the scale. Most of the EU, the US, Canada, the UK, UAE, Hong Kong… and another 27 jurisdictions are set to join the data-sharing club in 2028. This isn’t a test anymore. It’s infrastructure.

Does this kill crypto? No. Does it kill the illusion that crypto lives outside the system? Oui, clairement.

To me, this feels like adulthood. Less anonymity, more rules — but also more legitimacy. The Wild West phase is ending, and whether we like it or not, crypto is becoming a regulated asset class.

C’est la vie. Adapt, structure, and stay ahead of the curve 🧠

#Crypto #Regulation #CARF #Taxes #Compliance #FutureOfCrypto #CryptoFriture

From 2026, 48 countries start tracking crypto activity under CARF, with data sharing between tax authorities coming next.

I read this news with the same feeling you get when the sea suddenly goes flat — calm, but you know something big just shifted under the surface 🌊

As of January 1, 2026, the Crypto-Asset Reporting Framework, developed under the umbrella of the OECD, is now live in 48 countries. This year is about collecting data. In 2027, governments start exchanging it with each other.

Who’s concerned? Pretty much everyone with a bridge to fiat:

Centralized exchanges

Some DeFi platforms

Crypto ATMs

Brokers and custodians

The goal is clear: reduce tax evasion and money laundering. No drama, no ideology — just states doing what states always do when something gets big.

What’s interesting is the scale. Most of the EU, the US, Canada, the UK, UAE, Hong Kong… and another 27 jurisdictions are set to join the data-sharing club in 2028. This isn’t a test anymore. It’s infrastructure.

Does this kill crypto? No. Does it kill the illusion that crypto lives outside the system? Oui, clairement.

To me, this feels like adulthood. Less anonymity, more rules — but also more legitimacy. The Wild West phase is ending, and whether we like it or not, crypto is becoming a regulated asset class.

C’est la vie. Adapt, structure, and stay ahead of the curve 🧠

#Crypto #Regulation #CARF #Taxes #Compliance #FutureOfCrypto #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.