Burgers, bonuses and a Bitcoin reserve.

By Maxime Laurent · 2026-02-17 13:54

Burgers, bonuses and a Bitcoin reserve.

Steak ’n Shake boosts sales after adding $BTC payments — and stacks every coin.

I love when crypto leaves the charts and walks into real life.

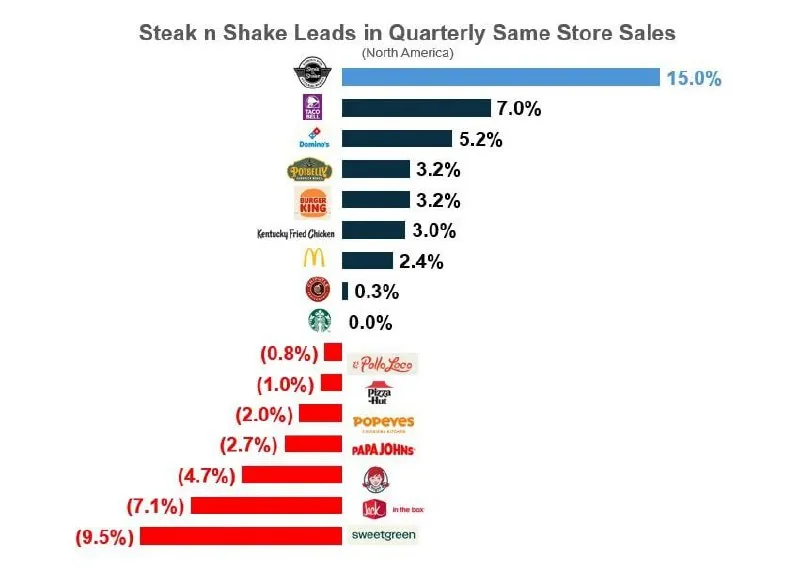

Steak 'n Shake reported a sharp rise in sales — up 11% and 15% — after launching $BTC payments in May 2025. Not only that, they outpaced giants like McDonald's, Domino's and Taco Bell in growth momentum.

That’s not a crypto-native startup.

That’s burgers and milkshakes.

Here’s where it gets spicy.

Every single bitcoin received through payments goes straight into a strategic Bitcoin reserve. No instant conversion to dollars. They’re stacking.

As of now, the company reportedly holds 161.6 BTC, worth around $10.9M.

And they didn’t stop there.

Last month, they announced hourly employees will receive bonuses in $BTC — $0.21 per hour worked, with a two-year vesting period.

Read that again.

A fast-food chain offering bitcoin-denominated compensation with vesting mechanics. That sounds more like a Web3 startup than a burger franchise.

Now, will this alone transform corporate treasury strategy? Probably not overnight.

But symbolically? It’s powerful.

This is how normalization spreads:

– First as speculation

– Then as treasury allocation

– Then as payment option

– Then as employee compensation

And suddenly $BTC isn’t just an asset. It’s part of operational finance.

Of course, critics will say it’s marketing. Maybe it is. But if marketing leads to balance sheet accumulation, does it matter?

From my terrace in the south of France, imagining paying for fries in bitcoin while the company quietly builds a reserve… I can’t help but smile.

Adoption doesn’t always look like Wall Street.

Sometimes it smells like grilled onions.

Ça sent la transition monétaire en douceur. 🍔🔥

#Bitcoin #BTC #Adoption #CorporateTreasury #Crypto #Payments

Steak ’n Shake boosts sales after adding $BTC payments — and stacks every coin.

I love when crypto leaves the charts and walks into real life.

Steak 'n Shake reported a sharp rise in sales — up 11% and 15% — after launching $BTC payments in May 2025. Not only that, they outpaced giants like McDonald's, Domino's and Taco Bell in growth momentum.

That’s not a crypto-native startup.

That’s burgers and milkshakes.

Here’s where it gets spicy.

Every single bitcoin received through payments goes straight into a strategic Bitcoin reserve. No instant conversion to dollars. They’re stacking.

As of now, the company reportedly holds 161.6 BTC, worth around $10.9M.

And they didn’t stop there.

Last month, they announced hourly employees will receive bonuses in $BTC — $0.21 per hour worked, with a two-year vesting period.

Read that again.

A fast-food chain offering bitcoin-denominated compensation with vesting mechanics. That sounds more like a Web3 startup than a burger franchise.

Now, will this alone transform corporate treasury strategy? Probably not overnight.

But symbolically? It’s powerful.

This is how normalization spreads:

– First as speculation

– Then as treasury allocation

– Then as payment option

– Then as employee compensation

And suddenly $BTC isn’t just an asset. It’s part of operational finance.

Of course, critics will say it’s marketing. Maybe it is. But if marketing leads to balance sheet accumulation, does it matter?

From my terrace in the south of France, imagining paying for fries in bitcoin while the company quietly builds a reserve… I can’t help but smile.

Adoption doesn’t always look like Wall Street.

Sometimes it smells like grilled onions.

Ça sent la transition monétaire en douceur. 🍔🔥

#Bitcoin #BTC #Adoption #CorporateTreasury #Crypto #Payments

Disclaimer: This content is for informational purposes only and not financial advice.