Bitcoin touched $60k and fear hit 2022 levels.

By Maxime Laurent · 2026-02-06 08:20

Bitcoin touched $60k and fear hit 2022 levels.

A violent dump, partial rebound to $65k, but sentiment just printed extreme panic not seen since Terra.

Last night was ugly. $BTC briefly flushed down to $60,000, one of the harshest selloffs we’ve seen in a long while. This morning brought a weak bounce back to the $65k–66k zone, but let’s be clear: the pressure hasn’t gone anywhere. It just caught its breath.

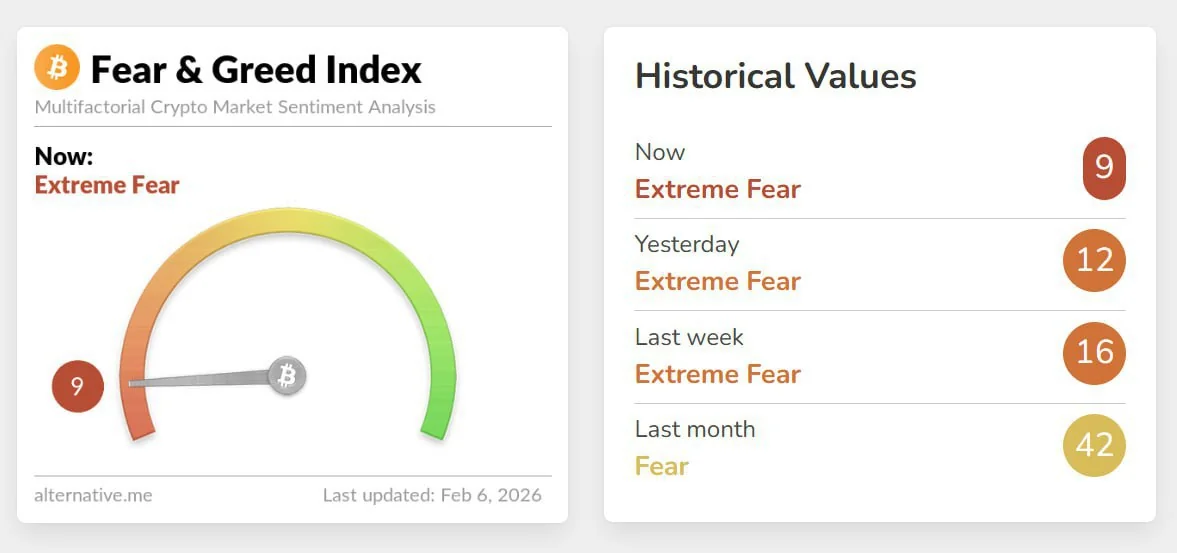

The mood says it all. The Fear & Greed Index collapsed to 9 — extreme fear — a level we haven’t seen since June 2022, during the collapse of Terra. Back then, everything felt broken. Today feels… disturbingly familiar.

Analysts point to uncomfortable possibilities: forced selling from sovereign funds, liquidity stress among large players, and potential sell pressure from Chinese-linked structures. None of this is confirmed, but markets don’t wait for confirmation — they react to risk of risk.

This is what late-stage panic looks like. Not loud euphoria turning to silence, but exhaustion, distrust, and people just wanting out at any price. Historically, these moments matter. Not because they feel good — but because they usually don’t last forever. On serre les dents. 🥶

#bitcoin #btc #crypto #markets #fear #capitulation #sentiment #volatility

A violent dump, partial rebound to $65k, but sentiment just printed extreme panic not seen since Terra.

Last night was ugly. $BTC briefly flushed down to $60,000, one of the harshest selloffs we’ve seen in a long while. This morning brought a weak bounce back to the $65k–66k zone, but let’s be clear: the pressure hasn’t gone anywhere. It just caught its breath.

The mood says it all. The Fear & Greed Index collapsed to 9 — extreme fear — a level we haven’t seen since June 2022, during the collapse of Terra. Back then, everything felt broken. Today feels… disturbingly familiar.

Analysts point to uncomfortable possibilities: forced selling from sovereign funds, liquidity stress among large players, and potential sell pressure from Chinese-linked structures. None of this is confirmed, but markets don’t wait for confirmation — they react to risk of risk.

This is what late-stage panic looks like. Not loud euphoria turning to silence, but exhaustion, distrust, and people just wanting out at any price. Historically, these moments matter. Not because they feel good — but because they usually don’t last forever. On serre les dents. 🥶

#bitcoin #btc #crypto #markets #fear #capitulation #sentiment #volatility

Disclaimer: This content is for informational purposes only and not financial advice.