“Bitcoin to zero” is trending again.

By Maxime Laurent · 2026-02-20 10:22

“Bitcoin to zero” is trending again.

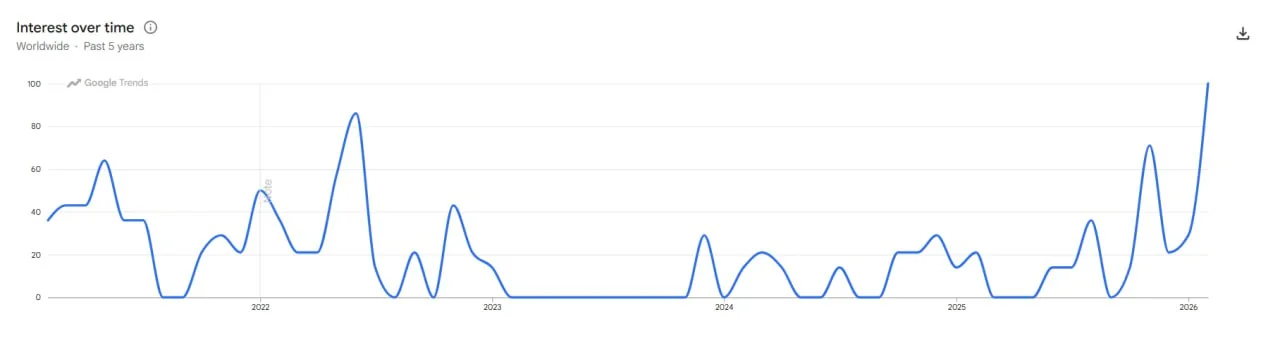

Google searches hit peak fear levels — just like in 2022.

Every cycle has this moment.

According to Google Trends, searches for “Bitcoin to zero” just hit 100 — the highest level since June 2022, when Terra collapsed and the market was burning from inside.

Back then, we had:

– TerraUSD imploding

– Funds going bankrupt

– Exchanges freezing withdrawals

– Panic everywhere

Today? The structure is different. But the emotion feels familiar.

Peak pessimism rarely appears during calm uptrends. It shows up when:

– Price compresses

– Headlines turn dark

– Social media amplifies worst-case scenarios

And here’s the thing I’ve learned after years in this space:

Search spikes are emotional indicators, not fundamental ones.

When retail searches “$BTC going to zero,” it usually means fear is already widespread. And markets tend to punish consensus fear just as brutally as they punish euphoria.

Does that mean we moon tomorrow?

Non.

But sentiment at extremes often signals late-stage panic, not early-stage collapse.

Let’s be rational for a second.

For $BTC to go to zero, you’d need:

– Network abandonment

– Hashrate collapse

– Global coordinated prohibition

– Institutional exodus

– Total loss of user belief

Is volatility possible? Of course.

Is zero realistic? That’s another story.

From my terrace in the south of France, watching the sunset while Twitter screams apocalypse, I feel something very different.

Not euphoria.

Not panic.

Just cycle fatigue.

Bitcoin has “died” hundreds of times in headlines. And yet, here we are — ETFs exist, corporations hold it, nations mine it.

Fear is loud.

Adoption is quieter.

And usually, the loudest moments are the most interesting ones.

Alors… you tell me. Panic or patience? 🌊🔥

#Bitcoin #BTC #Crypto #MarketSentiment #Fear #Cycles

Google searches hit peak fear levels — just like in 2022.

Every cycle has this moment.

According to Google Trends, searches for “Bitcoin to zero” just hit 100 — the highest level since June 2022, when Terra collapsed and the market was burning from inside.

Back then, we had:

– TerraUSD imploding

– Funds going bankrupt

– Exchanges freezing withdrawals

– Panic everywhere

Today? The structure is different. But the emotion feels familiar.

Peak pessimism rarely appears during calm uptrends. It shows up when:

– Price compresses

– Headlines turn dark

– Social media amplifies worst-case scenarios

And here’s the thing I’ve learned after years in this space:

Search spikes are emotional indicators, not fundamental ones.

When retail searches “$BTC going to zero,” it usually means fear is already widespread. And markets tend to punish consensus fear just as brutally as they punish euphoria.

Does that mean we moon tomorrow?

Non.

But sentiment at extremes often signals late-stage panic, not early-stage collapse.

Let’s be rational for a second.

For $BTC to go to zero, you’d need:

– Network abandonment

– Hashrate collapse

– Global coordinated prohibition

– Institutional exodus

– Total loss of user belief

Is volatility possible? Of course.

Is zero realistic? That’s another story.

From my terrace in the south of France, watching the sunset while Twitter screams apocalypse, I feel something very different.

Not euphoria.

Not panic.

Just cycle fatigue.

Bitcoin has “died” hundreds of times in headlines. And yet, here we are — ETFs exist, corporations hold it, nations mine it.

Fear is loud.

Adoption is quieter.

And usually, the loudest moments are the most interesting ones.

Alors… you tell me. Panic or patience? 🌊🔥

#Bitcoin #BTC #Crypto #MarketSentiment #Fear #Cycles

Disclaimer: This content is for informational purposes only and not financial advice.