Bitcoin miners drown in debt chasing hashpower.

By Maxime Laurent · 2025-10-25 09:37

Bitcoin miners drown in debt chasing hashpower.

Total liabilities explode 500% in a year. ⚡️💰

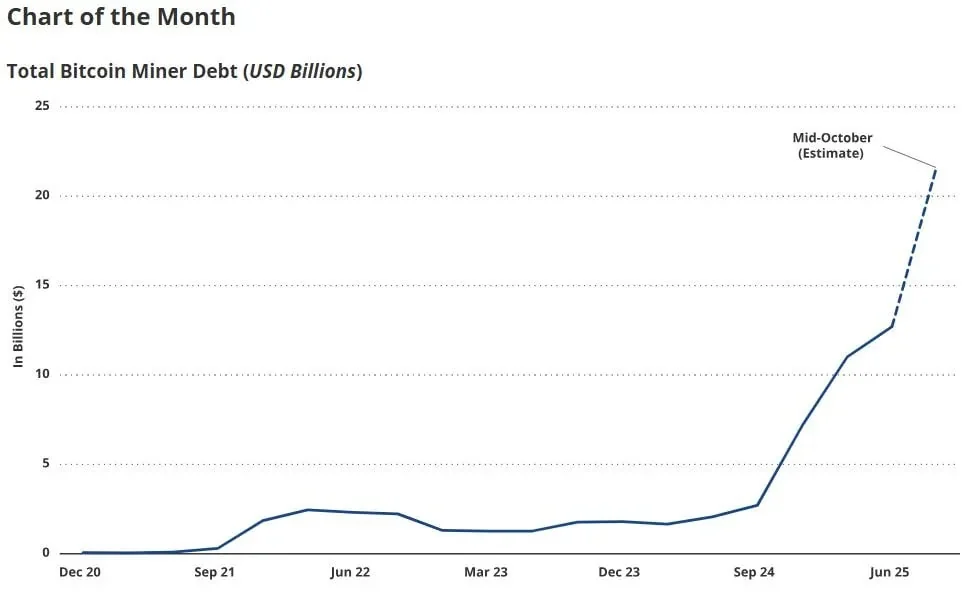

According to VanEck, the combined debt of Bitcoin miners has surged from $2.1B to $12.7B over the past year — a staggering +500% jump. The reason? A double squeeze: massive spending on next-gen mining rigs and growing competition for AI infrastructure contracts.

Traditionally, miners raised capital through stock offerings, but now they’re leaning hard on debt financing to stay in the race. Without constant reinvestment, their share of the global $BTC hashrate shrinks — and so does their reward.

It’s a brutal cycle: more loans to mine more coins, while profitability tightens. Mining’s turning into high-stakes finance, not just raw computing power. Comme un vrai champ de bataille. 🧨

#Bitcoin #BTC #Mining #VanEck #Debt #CryptoNews #Hashrate #Blockchain

Total liabilities explode 500% in a year. ⚡️💰

According to VanEck, the combined debt of Bitcoin miners has surged from $2.1B to $12.7B over the past year — a staggering +500% jump. The reason? A double squeeze: massive spending on next-gen mining rigs and growing competition for AI infrastructure contracts.

Traditionally, miners raised capital through stock offerings, but now they’re leaning hard on debt financing to stay in the race. Without constant reinvestment, their share of the global $BTC hashrate shrinks — and so does their reward.

It’s a brutal cycle: more loans to mine more coins, while profitability tightens. Mining’s turning into high-stakes finance, not just raw computing power. Comme un vrai champ de bataille. 🧨

#Bitcoin #BTC #Mining #VanEck #Debt #CryptoNews #Hashrate #Blockchain

Disclaimer: This content is for informational purposes only and not financial advice.