Binance still dominates the crypto exchange game.

By Maxime Laurent · 2025-12-15 09:39

Binance still dominates the crypto exchange game.

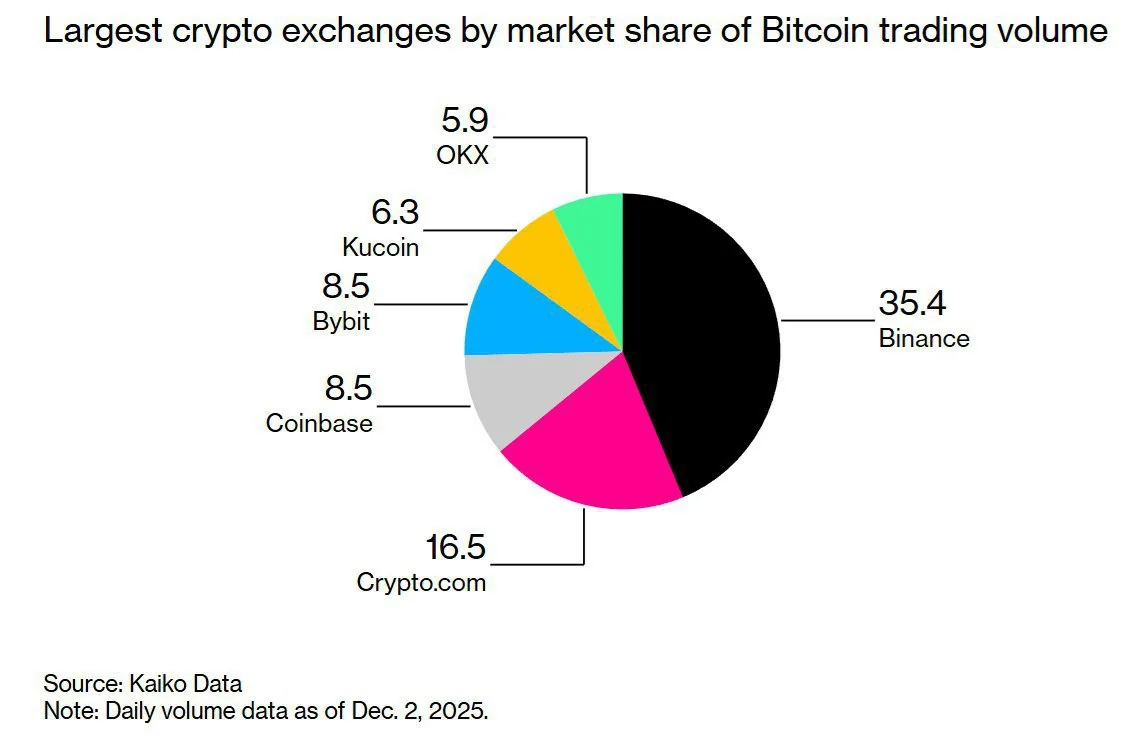

New data confirms Binance leads with 35.4% market share, far ahead of competitors.

I’ve seen many cycles where people swear “this is the end of Binance”. And yet, here we are again. Quietly, numbers doing the talking. 35.4% of the global market is massive. Crypto.com follows with 16.5%, while Bybit and Coinbase share third place at 8.5%. The gap is not small — it’s structural.

What really matters is under the hood. Binance still has the deepest liquidity on $BTC and $ETH, which is what serious traders care about when things get volatile. Over 170 million registered users, daily volumes hovering between $30–40 billion, and up to 50% control of the derivatives market — that’s not luck, that’s infrastructure.

And then there’s the reserves. More than 100% backing against obligations. After all the chaos this industry has lived through, that detail alone carries weight. Trust is fragile in crypto, but solvency speaks louder than marketing.

From my sunny spot in the south, watching markets with one eye and the sea with the other 🌊, this feels like a moment of clarity. You don’t have to like Binance to admit it’s still the center of gravity. At least for now. Tranquille.

Leadership doesn’t mean invincible. But let’s be honest — no serious challenger is knocking on the door yet.

#Binance #CryptoExchanges #BTC #ETH #CryptoMarket #Trading #MarketShare

New data confirms Binance leads with 35.4% market share, far ahead of competitors.

I’ve seen many cycles where people swear “this is the end of Binance”. And yet, here we are again. Quietly, numbers doing the talking. 35.4% of the global market is massive. Crypto.com follows with 16.5%, while Bybit and Coinbase share third place at 8.5%. The gap is not small — it’s structural.

What really matters is under the hood. Binance still has the deepest liquidity on $BTC and $ETH, which is what serious traders care about when things get volatile. Over 170 million registered users, daily volumes hovering between $30–40 billion, and up to 50% control of the derivatives market — that’s not luck, that’s infrastructure.

And then there’s the reserves. More than 100% backing against obligations. After all the chaos this industry has lived through, that detail alone carries weight. Trust is fragile in crypto, but solvency speaks louder than marketing.

From my sunny spot in the south, watching markets with one eye and the sea with the other 🌊, this feels like a moment of clarity. You don’t have to like Binance to admit it’s still the center of gravity. At least for now. Tranquille.

Leadership doesn’t mean invincible. But let’s be honest — no serious challenger is knocking on the door yet.

#Binance #CryptoExchanges #BTC #ETH #CryptoMarket #Trading #MarketShare

Disclaimer: This content is for informational purposes only and not financial advice.