Betting on war again.

By Maxime Laurent · 2026-02-20 10:21

Betting on war again.

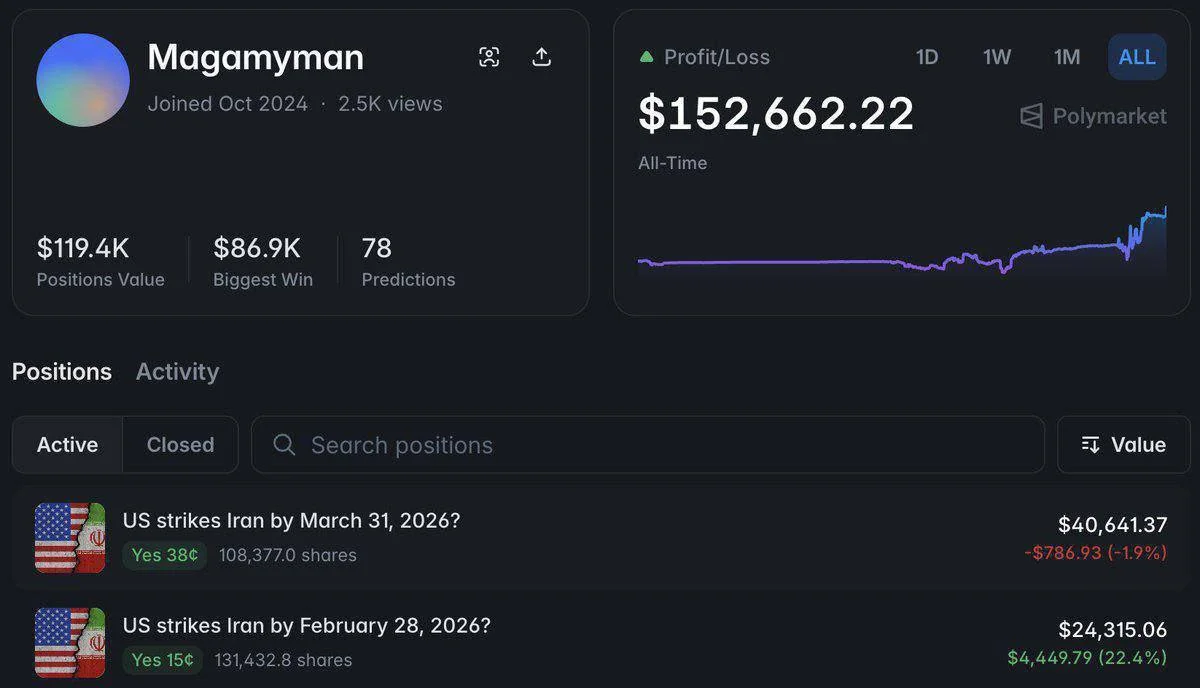

A trader who made $278K on Middle East strikes now opens fresh escalation positions.

Some people trade charts.

Some trade geopolitics.

This trader — who previously earned around $278,000 betting on Israeli strikes against Iran — has now opened new positions on possible US involvement.

$24,000 on escalation before the end of this month.

$40,000 on escalation before the end of next month.

If things intensify?

Potential profit: around $240,000.

Let’s call it what it is.

This isn’t investing.

It’s event-driven speculation on geopolitical risk.

Platforms that allow prediction-style markets have turned global tension into tradable instruments. You don’t need tanks or oil futures anymore — you just need conviction and timing.

From a pure trading perspective, it’s asymmetric:

– Defined downside (your stake)

– High payout if the event happens

– Binary outcome

But emotionally? It’s heavy.

You’re effectively long instability.

And here’s the deeper layer for crypto markets:

Geopolitical escalation tends to trigger:

– Risk-off moves in equities

– Volatility spikes

– Dollar strength (initially)

– Narrative demand for hard assets like $BTC and gold

Short term, panic.

Medium term, hedging flows.

We’ve seen this pattern before.

Markets price fear brutally fast — often before headlines are fully confirmed. That’s why these traders position early. They don’t wait for CNN banners.

But let’s be clear: this is high-risk, binary speculation. If nothing happens, the $64,000 total stake evaporates.

From my terrace in the south of France, watching calm waters while traders place bets on conflict thousands of kilometers away… it feels surreal.

Crypto gave people financial sovereignty.

It also gave them the ability to speculate on anything.

Même la guerre.

Stay sharp. Volatility doesn’t send invitations. 🔥

#Crypto #Trading #Geopolitics #Bitcoin #Markets #RiskManagement

A trader who made $278K on Middle East strikes now opens fresh escalation positions.

Some people trade charts.

Some trade geopolitics.

This trader — who previously earned around $278,000 betting on Israeli strikes against Iran — has now opened new positions on possible US involvement.

$24,000 on escalation before the end of this month.

$40,000 on escalation before the end of next month.

If things intensify?

Potential profit: around $240,000.

Let’s call it what it is.

This isn’t investing.

It’s event-driven speculation on geopolitical risk.

Platforms that allow prediction-style markets have turned global tension into tradable instruments. You don’t need tanks or oil futures anymore — you just need conviction and timing.

From a pure trading perspective, it’s asymmetric:

– Defined downside (your stake)

– High payout if the event happens

– Binary outcome

But emotionally? It’s heavy.

You’re effectively long instability.

And here’s the deeper layer for crypto markets:

Geopolitical escalation tends to trigger:

– Risk-off moves in equities

– Volatility spikes

– Dollar strength (initially)

– Narrative demand for hard assets like $BTC and gold

Short term, panic.

Medium term, hedging flows.

We’ve seen this pattern before.

Markets price fear brutally fast — often before headlines are fully confirmed. That’s why these traders position early. They don’t wait for CNN banners.

But let’s be clear: this is high-risk, binary speculation. If nothing happens, the $64,000 total stake evaporates.

From my terrace in the south of France, watching calm waters while traders place bets on conflict thousands of kilometers away… it feels surreal.

Crypto gave people financial sovereignty.

It also gave them the ability to speculate on anything.

Même la guerre.

Stay sharp. Volatility doesn’t send invitations. 🔥

#Crypto #Trading #Geopolitics #Bitcoin #Markets #RiskManagement

Disclaimer: This content is for informational purposes only and not financial advice.