Another DeFi protocol fades away.

By Maxime Laurent · 2026-02-17 13:54

Another DeFi protocol fades away.

ZeroLend shuts down — low liquidity, dead chains, no profit. Reality hits hard.

This one feels less dramatic, more… inevitable.

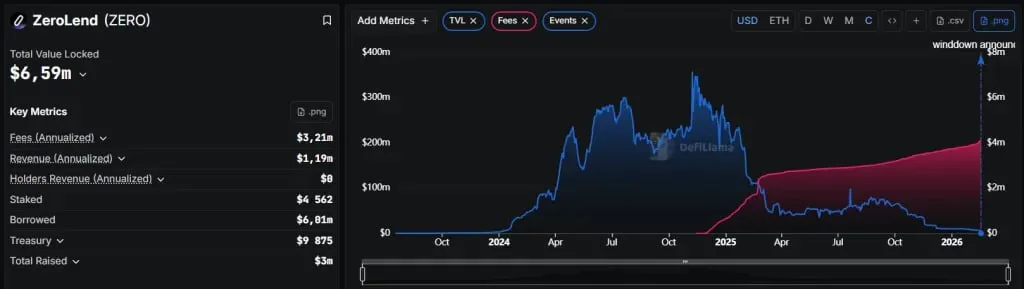

The decentralized lending protocol ZeroLend, launched in 2023, is officially shutting down. The founder, known as Ryker, cited low liquidity across supported networks, declining activity, oracle disruptions, and a business model that simply wasn’t profitable.

Add constant hacks, scam attempts, and razor-thin margins — and you get the classic DeFi exhaustion story.

When some of the blockchains you support become inactive and oracles stop feeding data, you’re not running a money market anymore. You’re maintaining a ghost town.

And that’s the uncomfortable truth about DeFi 2022–2025: too many protocols launched on hype, too many chains fragmented liquidity, and not enough sustainable revenue models were built.

The team urged users to withdraw funds immediately. Meanwhile, the ZERO token dropped over 33% after the announcement.

This isn’t just a “bad luck” story.

DeFi lending only works when:

– Liquidity is deep

– Borrow demand is real

– Collateral markets are active

– Oracles are reliable

– Exploits are minimized

Remove two or three of those pillars, and the whole structure weakens fast.

We romanticize decentralization. But decentralization without economic gravity doesn’t survive.

I’ve seen cycles like this before. After every hype phase, the weak protocols disappear. What remains? The ones with sticky liquidity, strong communities, and real revenue.

It’s brutal, but it’s also cleansing.

Crypto doesn’t need 200 lending protocols.

It needs 5 that actually work.

C’est la sélection naturelle version blockchain. 🔥

#Crypto #DeFi #ZeroLend #Lending #Web3 #MarketCycles

ZeroLend shuts down — low liquidity, dead chains, no profit. Reality hits hard.

This one feels less dramatic, more… inevitable.

The decentralized lending protocol ZeroLend, launched in 2023, is officially shutting down. The founder, known as Ryker, cited low liquidity across supported networks, declining activity, oracle disruptions, and a business model that simply wasn’t profitable.

Add constant hacks, scam attempts, and razor-thin margins — and you get the classic DeFi exhaustion story.

When some of the blockchains you support become inactive and oracles stop feeding data, you’re not running a money market anymore. You’re maintaining a ghost town.

And that’s the uncomfortable truth about DeFi 2022–2025: too many protocols launched on hype, too many chains fragmented liquidity, and not enough sustainable revenue models were built.

The team urged users to withdraw funds immediately. Meanwhile, the ZERO token dropped over 33% after the announcement.

This isn’t just a “bad luck” story.

DeFi lending only works when:

– Liquidity is deep

– Borrow demand is real

– Collateral markets are active

– Oracles are reliable

– Exploits are minimized

Remove two or three of those pillars, and the whole structure weakens fast.

We romanticize decentralization. But decentralization without economic gravity doesn’t survive.

I’ve seen cycles like this before. After every hype phase, the weak protocols disappear. What remains? The ones with sticky liquidity, strong communities, and real revenue.

It’s brutal, but it’s also cleansing.

Crypto doesn’t need 200 lending protocols.

It needs 5 that actually work.

C’est la sélection naturelle version blockchain. 🔥

#Crypto #DeFi #ZeroLend #Lending #Web3 #MarketCycles

Disclaimer: This content is for informational purposes only and not financial advice.