America may finally let crypto breathe.

By Maxime Laurent · 2025-12-22 08:57

America may finally let crypto breathe.

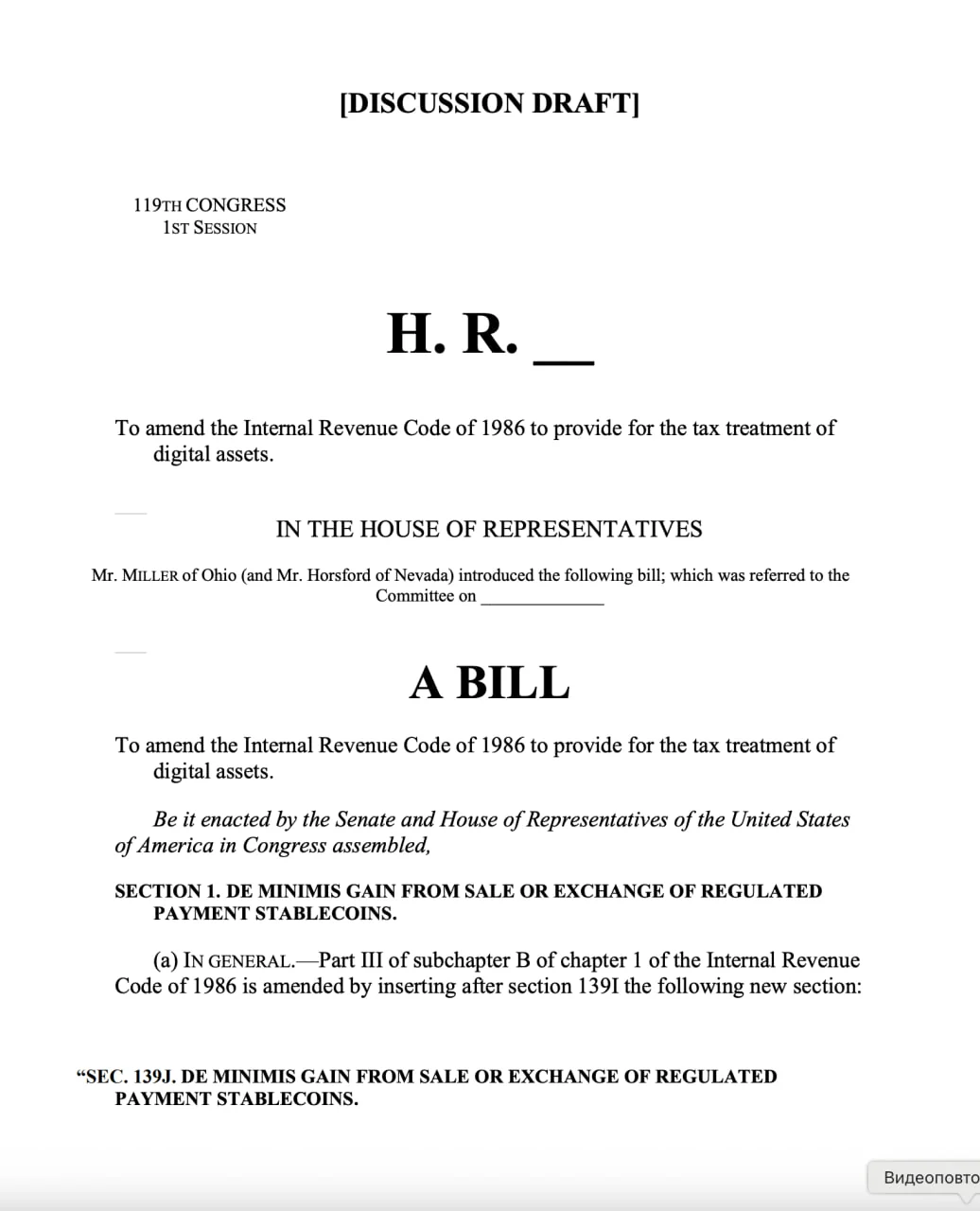

A new US bill could ease taxes on stablecoins and delay staking taxes, making crypto feel less like a tax trap and more like money.

I was scrolling this under a blue Provençal sky, and for once, the news didn’t taste bitter ☀️

In the US, members of the United States House of Representatives just dropped a proposal that feels… surprisingly sane.

The idea is simple:

If you pay small amounts with regulated stablecoins, no tax headache. Transactions under $200 in dollar-pegged stablecoins (think close to $1, no funny business) would be tax-free. That’s huge. That’s basically saying: okay, maybe stablecoins can act like digital cash.

And honestly, about time.

Right now, buying a coffee with crypto can technically trigger a taxable event. That’s absurd. Nobody wants to calculate capital gains over a croissant 🥐

This proposal cuts that nonsense and nudges stablecoins toward real-world usage, not just trading pairs and DeFi loops.

The other spicy part 🌶

Staking and mining rewards wouldn’t be taxed immediately anymore. Instead of paying taxes the moment rewards hit your wallet, taxation could be deferred up to five years. That’s massive for stakers who currently owe taxes on tokens they might not even sell.

For years, I’ve said this: taxing unrealized, illiquid crypto rewards is broken. This bill at least acknowledges reality.

Will it pass? No idea. US politics is its own jungle.

But the signal matters. It tells me regulators are slowly realizing crypto isn’t just a casino — it’s infrastructure.

C’est pas trop tôt.

Let’s see if they follow through 👀

#CryptoRegulation #Stablecoins #Staking #USCrypto #DigitalCash #CryptoFriture

A new US bill could ease taxes on stablecoins and delay staking taxes, making crypto feel less like a tax trap and more like money.

I was scrolling this under a blue Provençal sky, and for once, the news didn’t taste bitter ☀️

In the US, members of the United States House of Representatives just dropped a proposal that feels… surprisingly sane.

The idea is simple:

If you pay small amounts with regulated stablecoins, no tax headache. Transactions under $200 in dollar-pegged stablecoins (think close to $1, no funny business) would be tax-free. That’s huge. That’s basically saying: okay, maybe stablecoins can act like digital cash.

And honestly, about time.

Right now, buying a coffee with crypto can technically trigger a taxable event. That’s absurd. Nobody wants to calculate capital gains over a croissant 🥐

This proposal cuts that nonsense and nudges stablecoins toward real-world usage, not just trading pairs and DeFi loops.

The other spicy part 🌶

Staking and mining rewards wouldn’t be taxed immediately anymore. Instead of paying taxes the moment rewards hit your wallet, taxation could be deferred up to five years. That’s massive for stakers who currently owe taxes on tokens they might not even sell.

For years, I’ve said this: taxing unrealized, illiquid crypto rewards is broken. This bill at least acknowledges reality.

Will it pass? No idea. US politics is its own jungle.

But the signal matters. It tells me regulators are slowly realizing crypto isn’t just a casino — it’s infrastructure.

C’est pas trop tôt.

Let’s see if they follow through 👀

#CryptoRegulation #Stablecoins #Staking #USCrypto #DigitalCash #CryptoFriture

Disclaimer: This content is for informational purposes only and not financial advice.