85% of 2025 tokens are underwater.

By Maxime Laurent · 2026-02-18 15:19

85% of 2025 tokens are underwater.

The VC-to-retail token machine is breaking — and maybe that’s healthy.

I’ve been feeling it for months.

According to researcher Edgy, around 85% of tokens launched in 2025 are trading below their listing price. Even projects backed by top-tier venture funds are failing to generate sustainable demand.

That’s a massive shift.

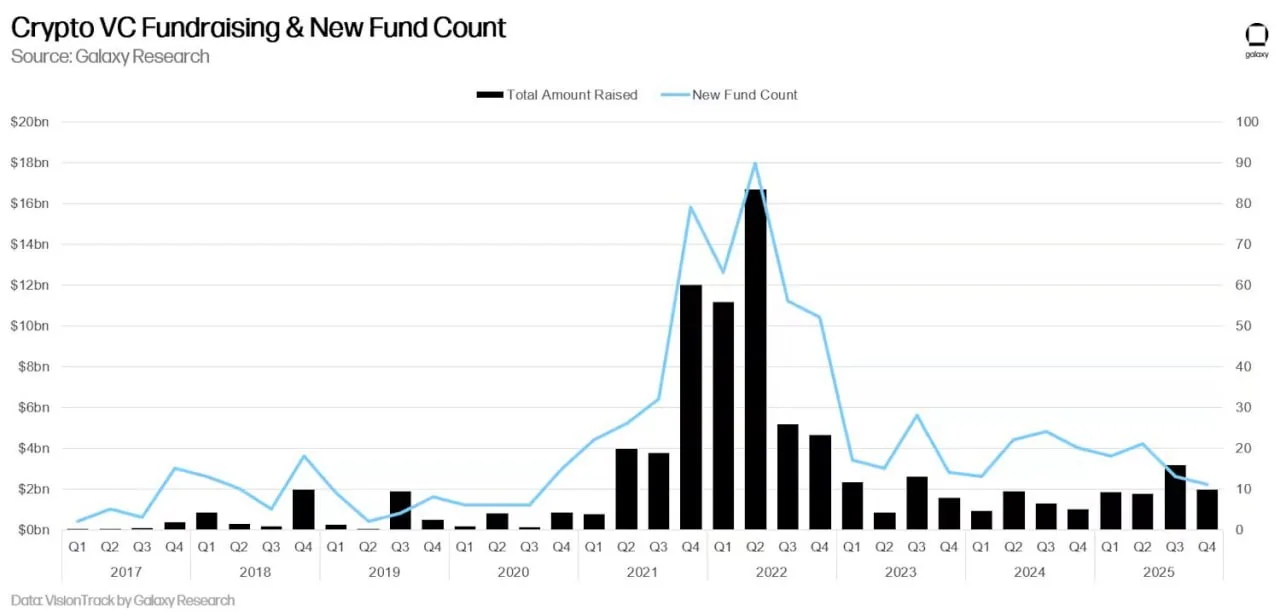

Back in Q2 2022, the crypto VC machine was in full euphoria mode. Funds raised nearly $17B in a single quarter. More than 80 new funds launched. Capital was everywhere.

Today?

According to Galaxy Research:

– VC ROI has been declining since 2022

– The number of new funds is at a five-year low

– Capital raised last quarter is just 12% of 2022 levels

That’s not a slowdown. That’s a structural cooldown.

And here’s the uncomfortable truth: the old model was simple.

1️⃣ Raise a round at a high valuation

2️⃣ Allocate a big chunk to insiders

3️⃣ Launch token

4️⃣ Retail provides exit liquidity

It worked in bull markets driven by narrative and easy money.

But now? Retail is smarter. Liquidity is tighter. Unlock schedules are public. Tokenomics are dissected on day one.

If 85% of new tokens are below listing, it means something profound: the market is no longer rewarding hype by default.

And honestly?

Good.

Because real businesses don’t rely on token launches to survive. They rely on revenue, users, sticky demand.

The next winners probably won’t be the ones with the flashiest funding rounds. They’ll be the ones with:

– Sustainable cash flow

– Real product-market fit

– Lower insider allocation

– Long-term alignment

We’re watching the death of the “easy launch” era.

Crypto is maturing. Painfully.

From my little corner by the Mediterranean, this doesn’t feel bearish. It feels like filtration.

Speculation built the first wave.

Utility builds the next one.

Ça devient plus sérieux maintenant. 🔥🌊

#Crypto #Web3 #VentureCapital #Tokenomics #Bitcoin #Startups

The VC-to-retail token machine is breaking — and maybe that’s healthy.

I’ve been feeling it for months.

According to researcher Edgy, around 85% of tokens launched in 2025 are trading below their listing price. Even projects backed by top-tier venture funds are failing to generate sustainable demand.

That’s a massive shift.

Back in Q2 2022, the crypto VC machine was in full euphoria mode. Funds raised nearly $17B in a single quarter. More than 80 new funds launched. Capital was everywhere.

Today?

According to Galaxy Research:

– VC ROI has been declining since 2022

– The number of new funds is at a five-year low

– Capital raised last quarter is just 12% of 2022 levels

That’s not a slowdown. That’s a structural cooldown.

And here’s the uncomfortable truth: the old model was simple.

1️⃣ Raise a round at a high valuation

2️⃣ Allocate a big chunk to insiders

3️⃣ Launch token

4️⃣ Retail provides exit liquidity

It worked in bull markets driven by narrative and easy money.

But now? Retail is smarter. Liquidity is tighter. Unlock schedules are public. Tokenomics are dissected on day one.

If 85% of new tokens are below listing, it means something profound: the market is no longer rewarding hype by default.

And honestly?

Good.

Because real businesses don’t rely on token launches to survive. They rely on revenue, users, sticky demand.

The next winners probably won’t be the ones with the flashiest funding rounds. They’ll be the ones with:

– Sustainable cash flow

– Real product-market fit

– Lower insider allocation

– Long-term alignment

We’re watching the death of the “easy launch” era.

Crypto is maturing. Painfully.

From my little corner by the Mediterranean, this doesn’t feel bearish. It feels like filtration.

Speculation built the first wave.

Utility builds the next one.

Ça devient plus sérieux maintenant. 🔥🌊

#Crypto #Web3 #VentureCapital #Tokenomics #Bitcoin #Startups

Disclaimer: This content is for informational purposes only and not financial advice.